What Is A Stock Watchlist?

Do you have a stock watchlist? A stock watchlist is, as the name indicates, a list of stocks that you are watching. Before you answer that, let me ask you, what do you do with a stock watchlist? Is it a list of stocks that you watch just for fun? Or do you anticipate actually taking a position in one or more of the stocks on your watchlist? What would make a stock from your watchlist to become a stock in which you take an actual position in the market?

Are You A Stock Watcher?

The answer depends on what kind of stock operator you are. Or if you are even a stock operator or not in the first place. For just a stock watcher who watches the market for fun, it does not matter what the stocks on his watchlist do. He usually follows the stocks in the news, or he will search up on google for “trending stocks” and the day’s trending stock will be on his watchlist. Does he cull his watchlist? Does he have a system to thin the herd to so to speak? Otherwise, the list will keep growing every day and every week with no direction and discipline.

Perhaps it offers this stock watcher a conversation starter. Or maybe it offers him a chance to tweet it out on social media to see if he can garner some followers. But without a sense of direction or some form of discipline or a goal, the watcher’s list will be a never-ending list with new stocks being added every day.

Are You A Stock Speculator?

What is you are a stock speculator? Some who observes what the stocks on his watchlist are doing? Gleaning through the price/volume action of the stocks on his list, he will interpret the action and draw certain conclusions. Such as, this stock is moving up in price. And that other stock is stuck in a price range and has not yet decided one way or the other which way to go. This other stock went up a little bit but has not yet started its true move. And so on.

The Perfect Watchlist

The perfect speculator will be on a quest for the perfect watchlist. The perfect watchlist is developed over time of weeks and months. A true trend does not begin and end in a few days. It takes time. Weeks and weeks and months and months. The perfect speculator knows from experience that he will never catch the bottom of a trending move. And more likely than not, he will probably will not be able to catch the top of the same trending move. Generally, it is far easier to catch the top of a move than the bottom of a move.

More money has been lost in the quest to catch the bottom of a move than anyone will ever know. The perfect speculator knows that the number of false starts outnumber the amount of dollars in trades one can place. There is no sense in losing your trading capital to try and catch the bottom. The real money is made after a true move has definitely begun. It is far better to be late and right than early and wrong.

The market has faced some hiccups the recent weeks. Some of the stocks on the speculator’s watchlist have probably offered the speculator an opportunity to move them from the front burner on to the back burner. It is a natural way of the market.

Initially, at what seems like the beginning of an uptrend, many stocks will be on your watchlist. That is because any new high is a potential winner. With the word “potential” being in quotes. At the beginning of a marathon, every runner has potential. After a mile, there is still a big pack of runners bunched together. As the miles stack on, the runners get bunched into groups and usually there is a lead pack that is leading the race. Similarly, it takes time after a trend has begun to identify the leading candidates.

Which Stocks Are On Your Watchlist?

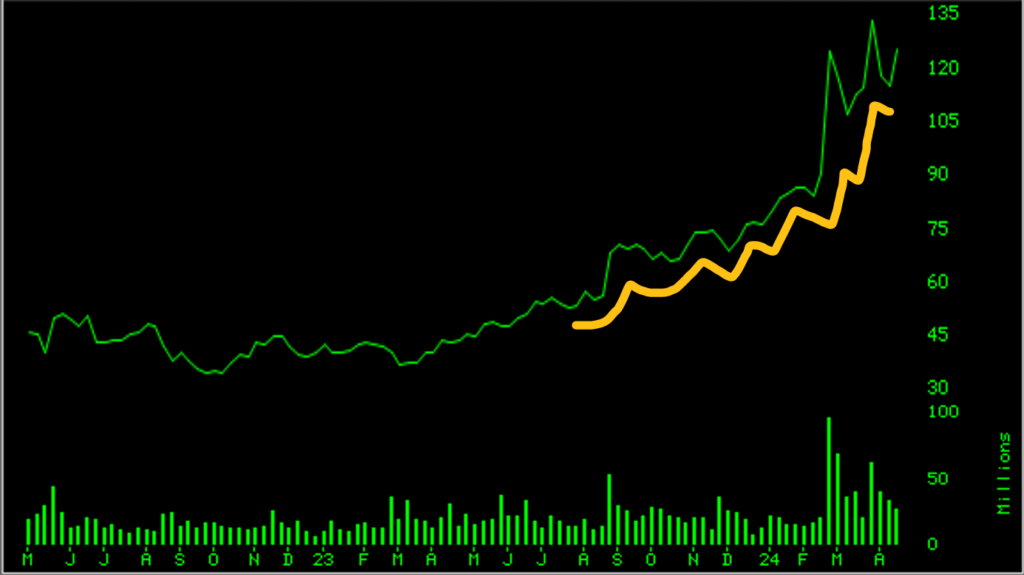

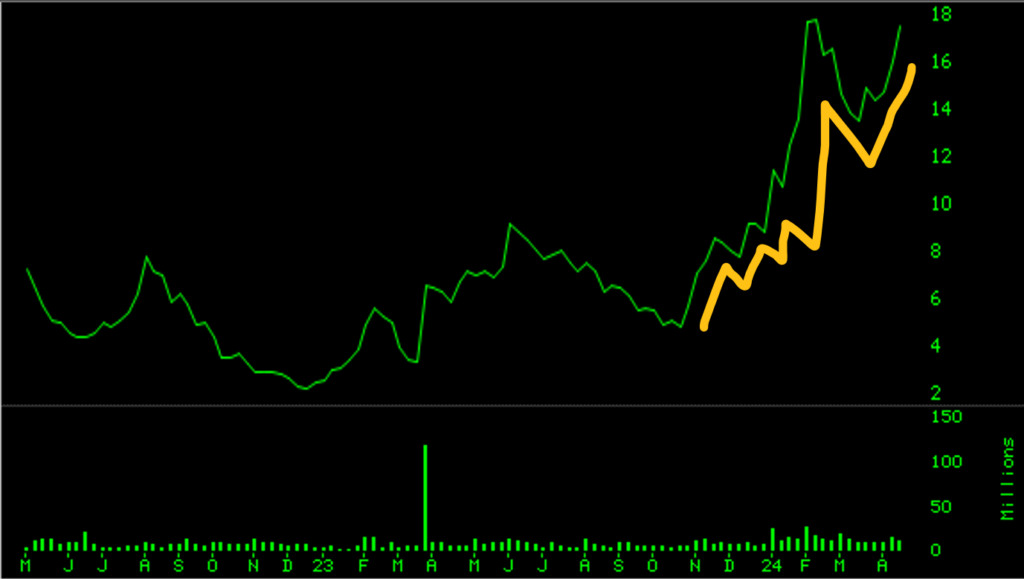

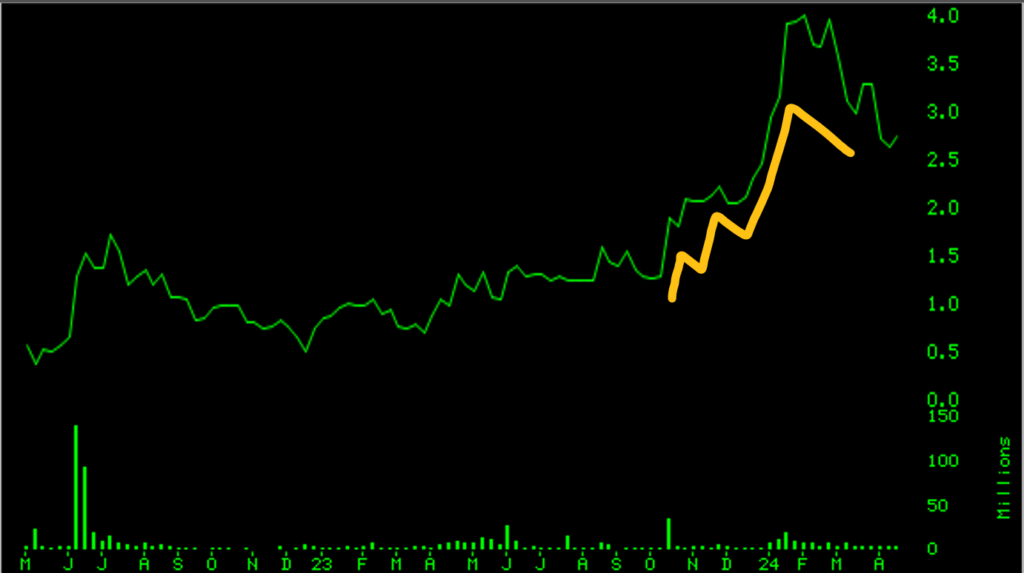

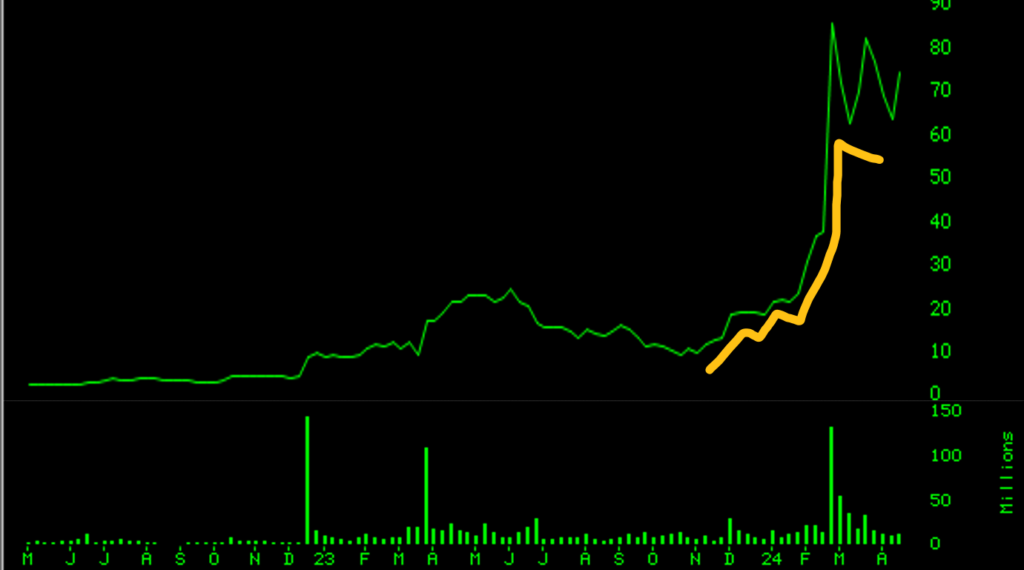

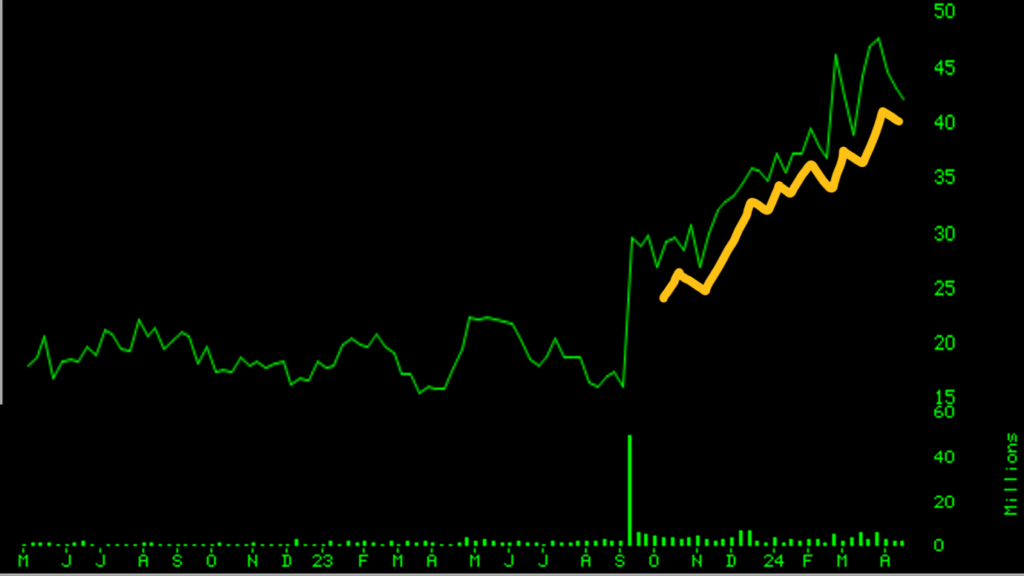

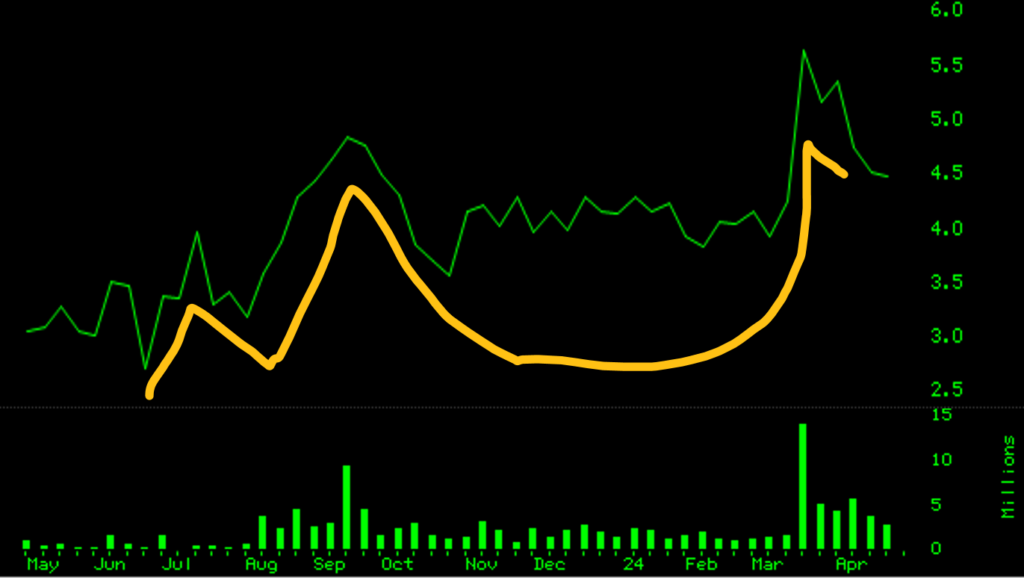

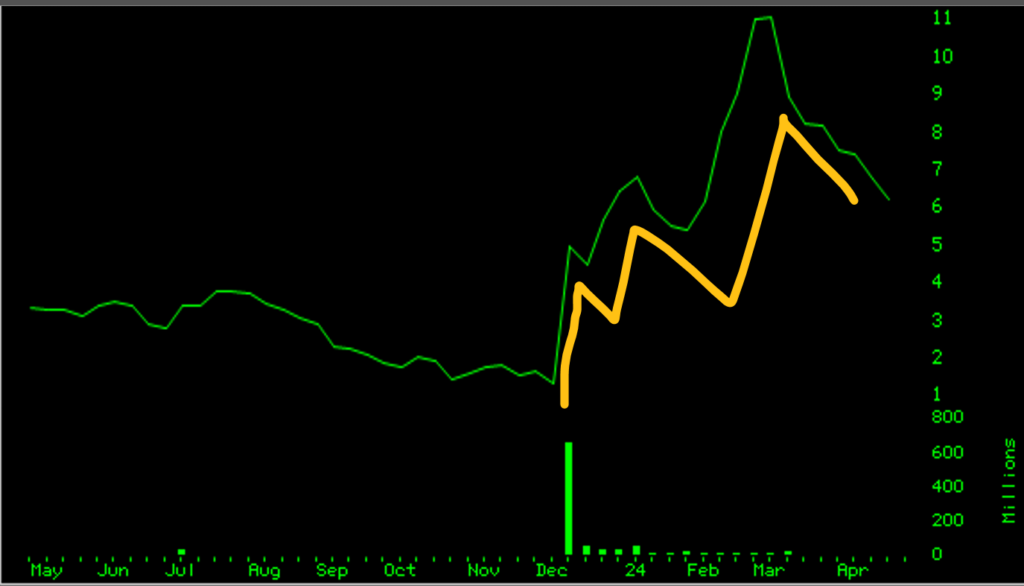

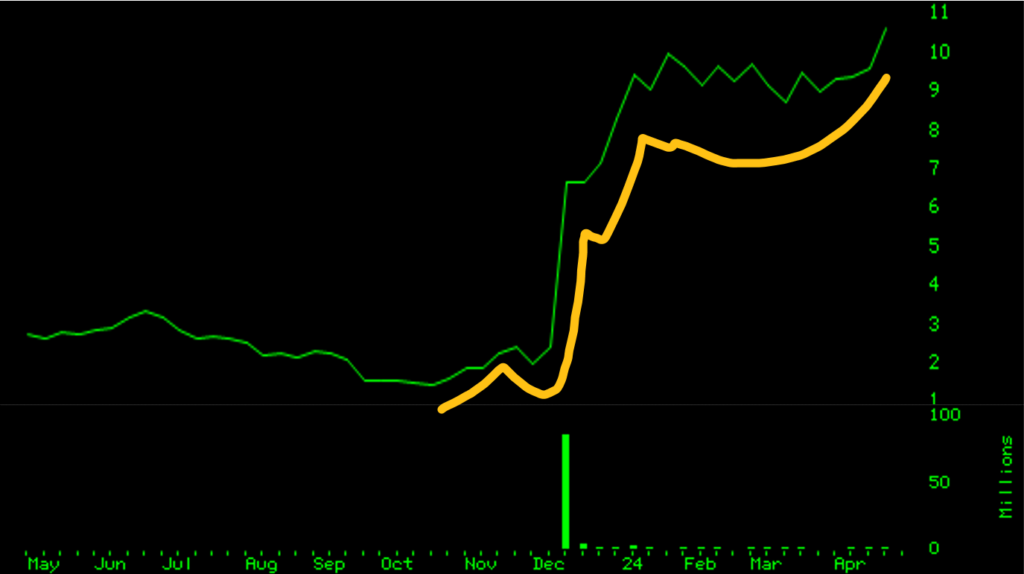

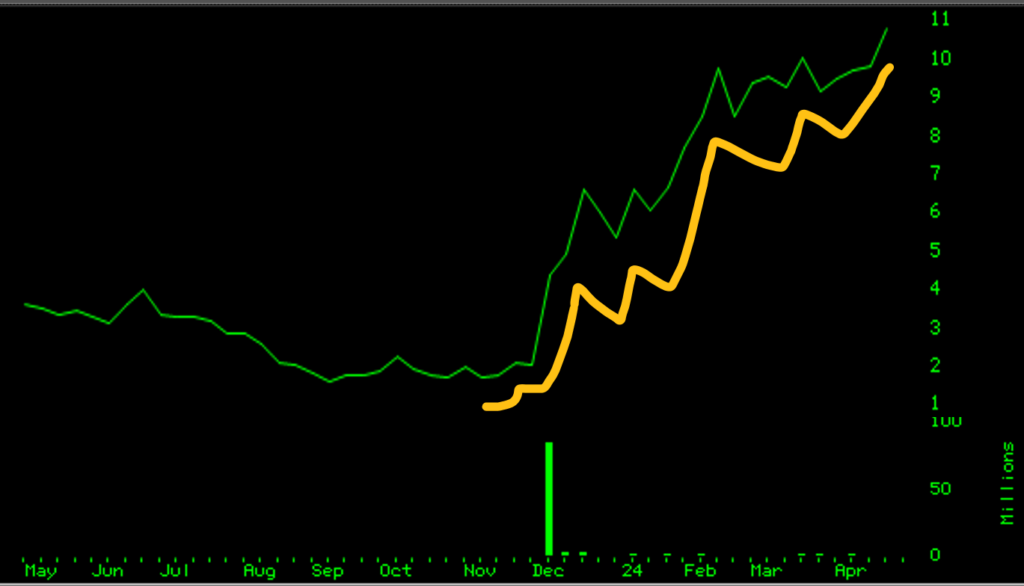

Clearly everyone has seen, heard of been whipsawed by the likes of Nvidia (NVDA) and Super Microcomputer (SMCI). And they may still have juice which one can never discount. All you can do is see if they can regain their prior high and then await their reaction to that new high. The clues will be crystal clear.

But until then, look at the others, perhaps some are obvious and on everyone’s watchlist and others are hidden. Are you able to recognize any of these charts? For the moment, these seem to be in the lead pack, maintaining their uptrend without a violation of their prior lows. Do any of these charts seem familiar to you?

Stock #1

Stock #2

Stock #3

Stock #4

Stock#5

Stock #6

Stock #7

Stock #8

Stock #9

Will others join this pack? Or will this pack get thinned out further? These potential runners are arranged in no particular order. Bide your time and the answer will be evident. It will be obvious to the observer as the one who wants to win will separate from the rest in due time.