Which Stocks Showed Unusual Activity Last Week?

The market wants to go up and yet it doesn’t. Stocks have been choppy yet there are some gems that may offer a sustained trend. A choppy market offers no gains for the longs or the shorts. The bulls and the bears are tugging the rope with no significant move one way or the other. Despite this the market has been sporadically showing some stocks with interesting price/volume action.

This past week some of the familiar stocks showed interesting price volume action. Many of them have been commented on prior articles here. Carvana (CVNA) and Ardelyx (ARDX) and Immunity Bio (IBRX) come to mind right away. But under the radar there have been other names such as Aspen Aerogels (ASPN), CytomX Therapeutics (CTMX), Enliven Therapeutics (ELVN), Matterport (MTTR), and Candel Therapeutics (CADL) that have shown some signs of waking up.

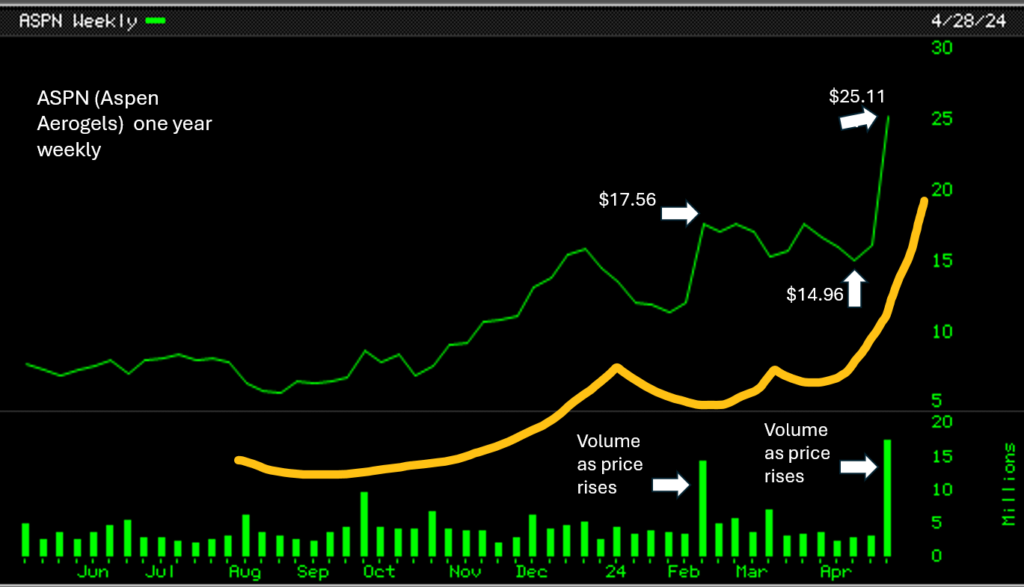

Aspen Aerogels (ASPN) Stock

Aspen Aerogels (ASPN), a building products and equipment maker, has been one of the lesser-known stocks that showed interesting action this past week. The obvious observation is that in February 2024, Aspen Aerogels (ASPN), showed its highest weekly volume in a while as it pegged a new closing high at $17.56. Volume expanded more than fourfold compared to the week prior. Price rose from $12 to $17.56 a share from the prior week, a gain of 46% to accompany the volume expansion.

After a few weeks of resting, Aspen Aerogels (ASPN), rose in price yet again this past week as its weekly volume was even higher than the volume of the prior new high set in February. More impressive was the price move from $16 to $25.11 in just this past week.

That is a 56% price gain in just the past week. One look at the chart clearly shows that behind the scenes something is more likely happening than not, and that is making its price and volume show the kind of action it is showing.

This should be a stock that should be on one’s watchlist.

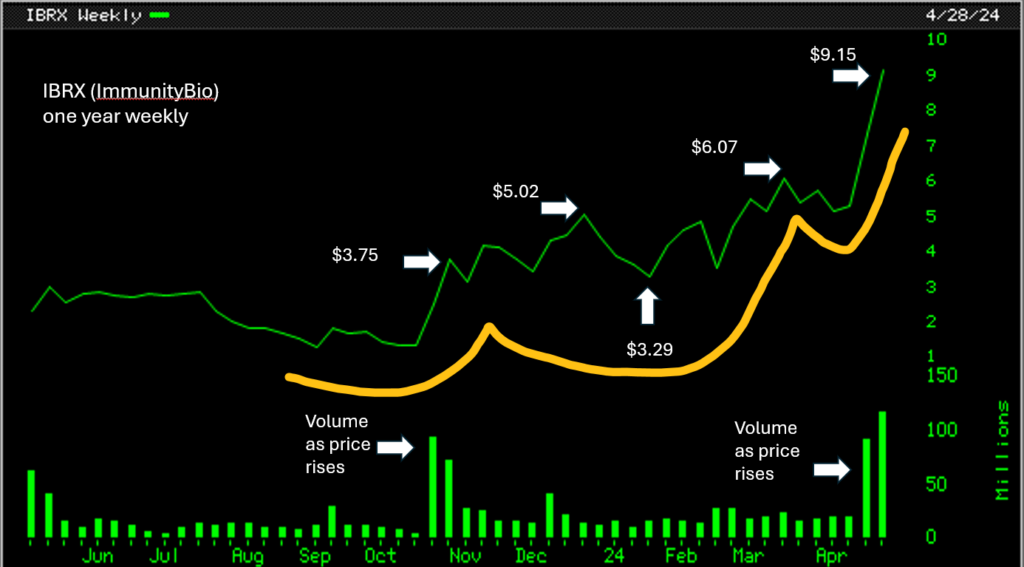

ImmunityBio (IBRX) Stock

Another impressive price/volume action this past week was on Immunity Bio (IBRX), a biotech. Some folks dismiss biotechs as impossible to trade. And there may be some truth to that. Others are inclined to trade biotechs without reservations claiming the best runs are in biotechs. And there is some truth to that too. The casual statement maker is all over the internet.

The challenge in any stock market operation is executing in real-time. The chart for Immunity Bio (IBRX) below shows some quite simple yet evident price/volume action for even the untrained eye to see. You don’t have to be in tune with the inner goings-on of IBRX to see what the chart says happened. Something clearly happened in October 2023 for IBRX to jump from trading 5.7 million shares one week to trading 94 million shares the next week. The volume jump of nineteen times clearly says something happened. That is unusual volume action. And you look at the price and that same week the price went from $1.30 per share to $3.75 per share. Almost tripled in price.

Some will chalk it up to just another biotech acting up, just to get folks excited and then when least expected some FDA approval somewhere gets trashed or some lawsuit from a competitor will hit the stock and IBRX will crash. There is some truth to that. Others will say that is the beginning of a real move. And there is some truth to that too.

Since no one has a crystal ball and the holy grail does not exist, humans being mortal and without any superhuman insight, we have no choice but to rely on what a stock’s price/volume action is showing. And the stock’s price/volume action will show and tell if you can really observe.

As any experienced stock operator will tell you, self-protection is crucial. We humans do stupid human things in the market. Self-protection does not mean an arbitrary stop from one’s buy price. That is self-destruction, not self-protection. There has to be some clear guidance as to why and where your self-protection stop is.

No matter what rules you use, there must be rules. Without rules there is no chance for any gains in the market. In a game of chances, a game of probabilities, where if this happens then that will more likely happen than not; rules are critical. What if instead of the anticipated this happening, the unanticipated that happens. If there is no self-protection, surely self-destruction will follow.

The market is what it is. No sense making predictions. They do not work. Logic will not work either. Survive long enough without getting wiped out and then the answers will become clearer. That is the learning process. But for many, surviving long enough is the most challenging obstacle. If one cannot survive long enough, how can one learn the lessons? More humans have come to market seeking profits and have never been heard from than those who are currently active in the market. But the machinery does not want to offer a warning because that will turn the faucet off.