Ardelyx (ARDX) – Rising? Falling? Range-Bound?

Biotechnology stocks come with a lot of risk. Sometimes the risk is rewarded, and other times it is not. It is the reward that drives hordes of players into the biotechnology sector. Whether it is private placements, venture capital or capital markets. All along the chain of events, any number of new players can join, and old players can leave without any allegiance. The sector is the truest form of cut-throat capitalism. Hence, biotechnology stocks invite all kinds of players, from the most sophisticated to the most naïve.

The risks are immense. An approval by the FDA of a pending application can skyrocket a stock’s price many times over. On the flip side, an FDA denial of application can burn even the savviest trader. The gap ups and gap downs are commonplace and the percentage moves, both down and up are staggering.

It is not just the unpredictability of the FDA action, but other factors also play a heavy hand with biotech stocks. Because the reward is so high for the entities involved, any whiff of competition brings all kinds of lawsuits and litigation, whether with reason or not is immaterial. With a constant need for capital injection, without warning a company may file for a secondary or tertiary offering of new public shares. All of a sudden diluting the stock. The market being the market, you can almost book it, the reaction is almost always wild.

Ardelyx (ADRX) is a typical biotech stock.

Ardelyx (ARDX) Stock Is Falling

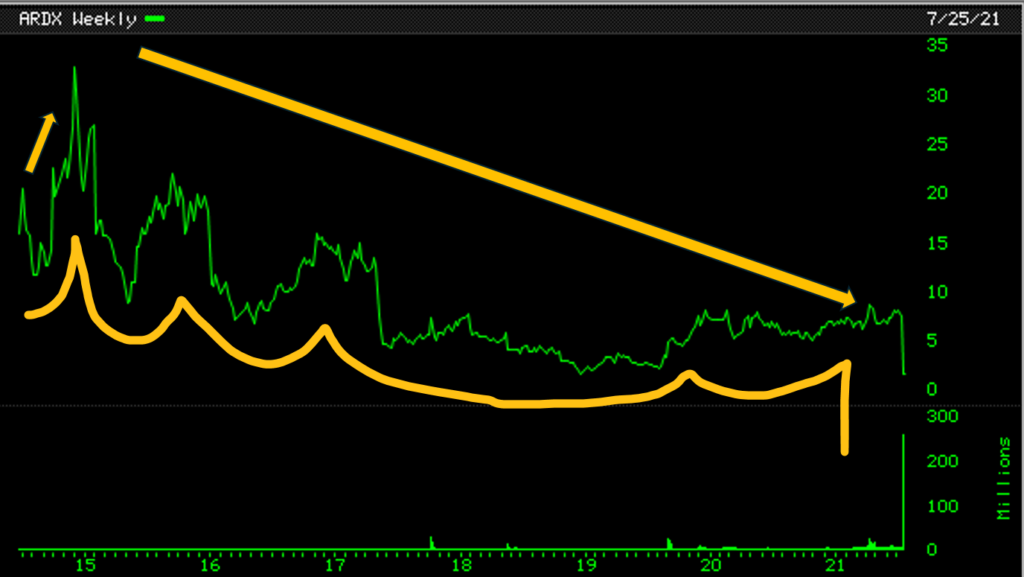

In mid-2014, Ardelyx (ARDX) came to market as a new biotechnology stock, full of vinegar and promise. The hype for a new IPO came with it. As is typical of any biotechnology stock, the pending panel of products in line for FDA approval was hyped. It started trading in the $15 a share range. Within six months the stock had doubled to over $30 a share. And that was the end of its upward trajectory.

From a high in 2014, Ardelyx started its long descent. As the years passed by, Ardelyx seemed to be destined to be a loser of a stock. From $30, it fell to $20. Then to $15. Then to $10. In 2021, it fell to around $7 a share. And as is common with biotechnology stocks banking on FDA approval, the slap by the FDA in rejecting its application resulted in its shares dropping from $7.50 a share to $1.68 a share. Anyone holding on to a large chunk of the stock was rendered a pauper overnight. He would have said that Ardelyx is a bad stock.

If you looked at its chart as shown above, the long downward trend was quite evident. The sudden drop at the very end of the downward trend was not unexpected for the experienced eye.

Ardelyx (ARDX) Stock Is Setting Up

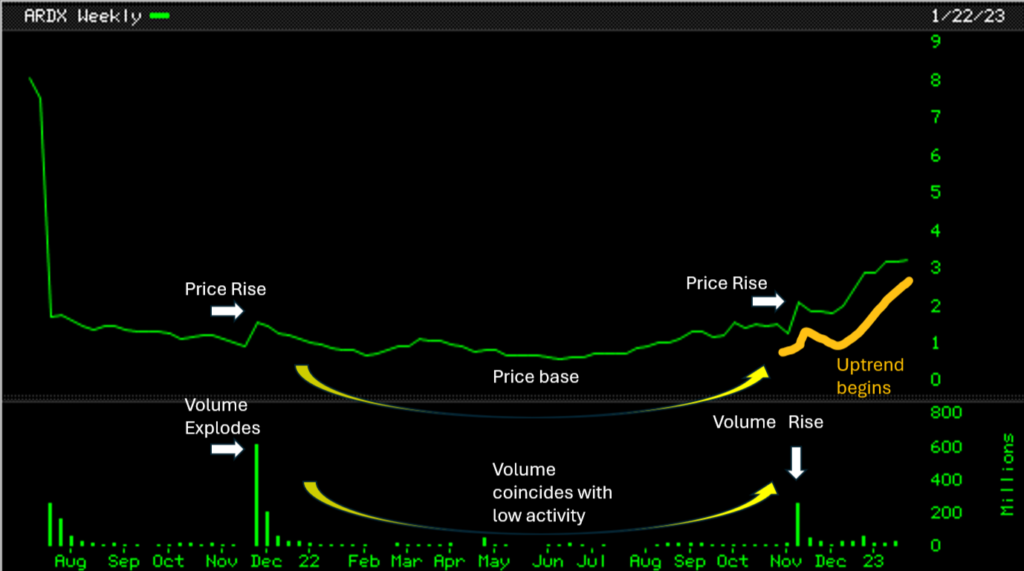

In November 2021, Ardelyx (ARDX) stock had fallen on hard times and reached a low price of 89 cents. That is $0.89 per share from its all-time high of over $30 a share. There was a very quiet week of trading during that November when Ardelyx logged its low. On that week when it logged its low price of $0.89, Ardelyx traded 8.58 million shares.

The very next week it traded over 620 million shares and closed at $1.52 a share. Something had happened. Behind the scenes it came to light that Ardelyx was filing a dispute resolution with the FDA. But it was not like this decision was made overnight. The insiders knew months in advance that this was coming. Such is the way of the stock market.

For the next twelve months, Ardelyx (ARDX) spent its time setting up a long base.

Ardelyx (ARDX) Stock Is Rising

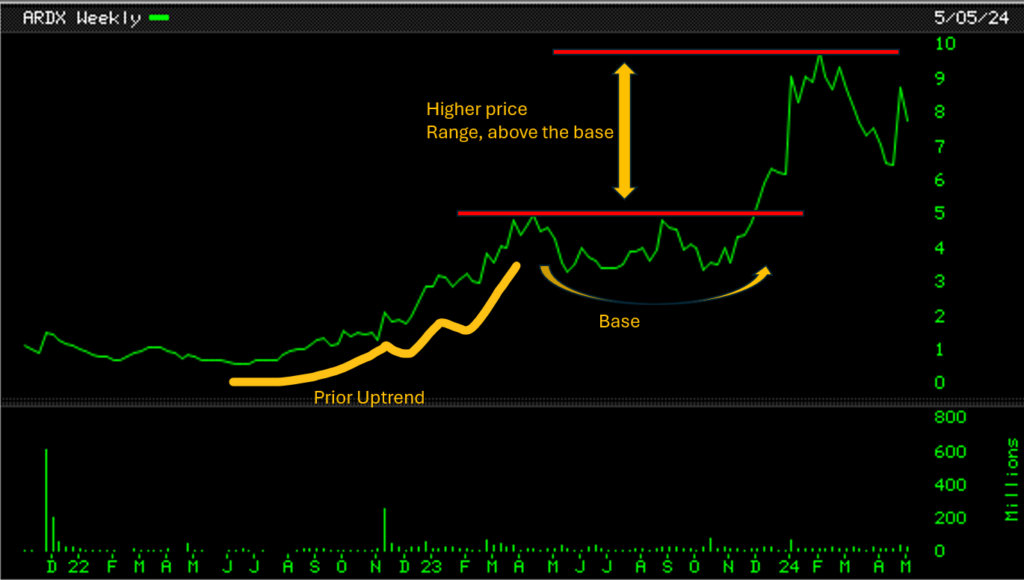

In November 2022, months before the general market turned the tide from its 2021-2023 bear phase, Ardelyx (ARDX) decided to jump the gun and started its rise from the depths of its doldrums. Within months it doubled in price, in advance of the general market turning its tide. And then settled in to form a months-long base between April 2023 and December 2023. As the general market seemed to turn, Ardelyx (ARDX) tripled in price between November 2023 and February 2024. Someone might have looked at the stock and said that Ardelyx (ARDX) is a good stock.

Ardelyx (ARDX) Stock Is Rangebound

Since February 2024, Ardelyx has been range bound. Maybe it is resting before looking to make new inroads to a higher price range. Or maybe, its run-up has been exhausted.

None of us is in the prediction business. But if you have your speculating rules in place, you can and will be able to do the right thing at the right time should the right action come about. Ardelyx (ARDX) is a biotech stock. It could just as easily gap down huge as it could gap up. Such is the danger of a biotech stock. Even good stocks are bad. Even bad stocks can be good.