Is Taiwan Semiconductor (TSM) A Good Stock To Buy?

Suppose you have no clue as to what is happening in the stock market. One day you open the window to the world of information about the stock market. You have no clue that opening that window is like opening Pandora’s Box. It is nothing but disinformation, misinformation, misdirection, misleading guidance, over hype and sleight of hand. Still knowing all that, and knowing that stocks are bad, you still cannot resist yourself.

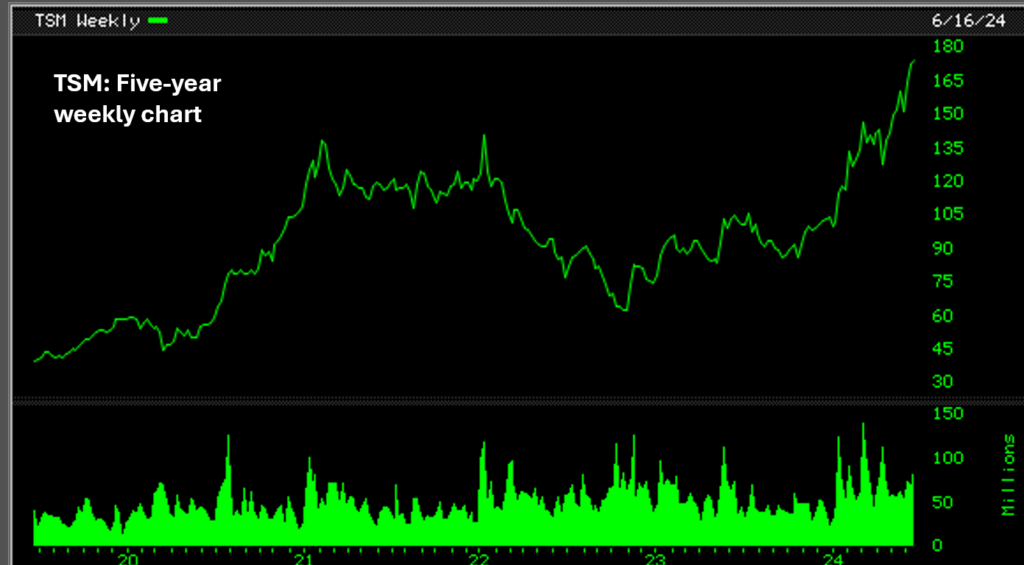

While you are trying to ignore the noise you yourself invited into your life, you notice the chart below. It is a five-year weekly chart of Taiwan Semiconductor (TSM). At first glance, nothing seems to stand out.

As you gather your thoughts, you decide to check on the prices at key points on the chart. To make it easier on your eyes, you enter the key prices at certain critical points on the chart. It is done quite subconsciously while your mind is somewhere else and only your eyes are paying attention to the chart.

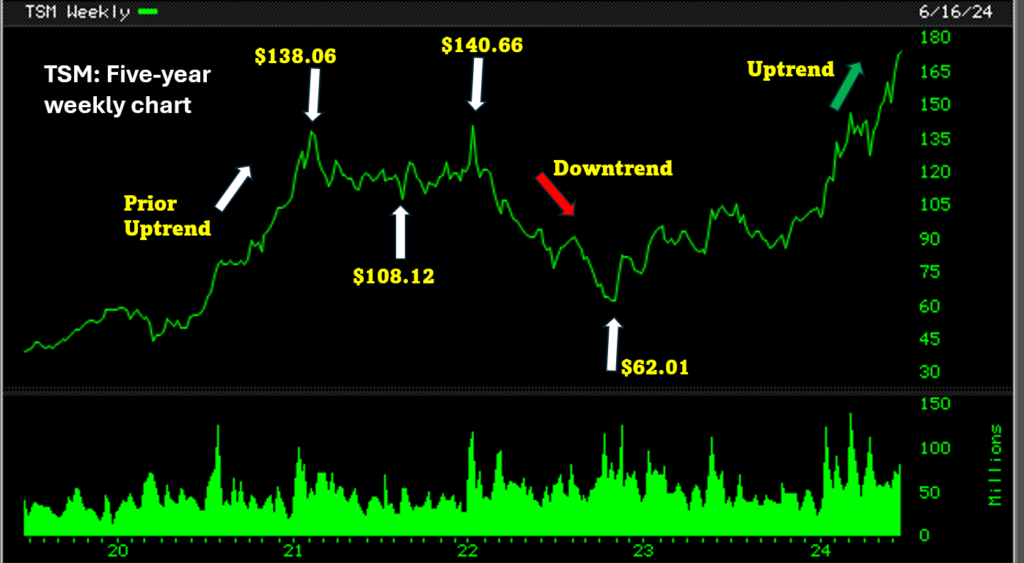

Within minutes you find yourself staring at the chart below.

Well, now. This is interesting. The prior uptrend is quite clear. The yearlong base from a high of $138.06 to the low of $108.12 to the new higher high of $140.66 is also pretty clear. Even though the general market started its bear move in the spring of 2021, Taiwan Semiconductor (TSM) did not want to give in. It held on till $140.66, a high it made in January 2022 before succumbing to the general market’s bear run. For an entire year, from February 2021 high of $138.06 to the January 2022 high of $140.66, Taiwan Semiconductor (TSM) did not want to let go of its bullish tendency.

After fighting valiantly, eventually it had to cave in as the general market pressure was just too much to confront and overcome. The downtrend from its January 2022 high to its low of $62.01 in October 2022 is also quite evident.

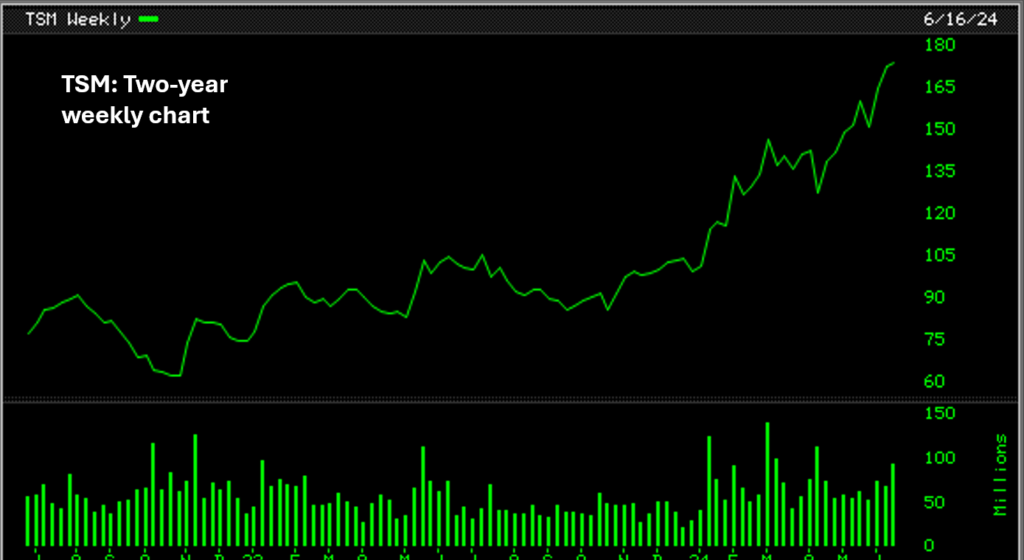

Now you decide to look closer at its more recent action and you decide to see what its two-year weekly chart can show you. Again, at first glance a chart is a chart, and nothing really stands out.

Is Taiwan Semiconductor (TSM) A Bad Stock?

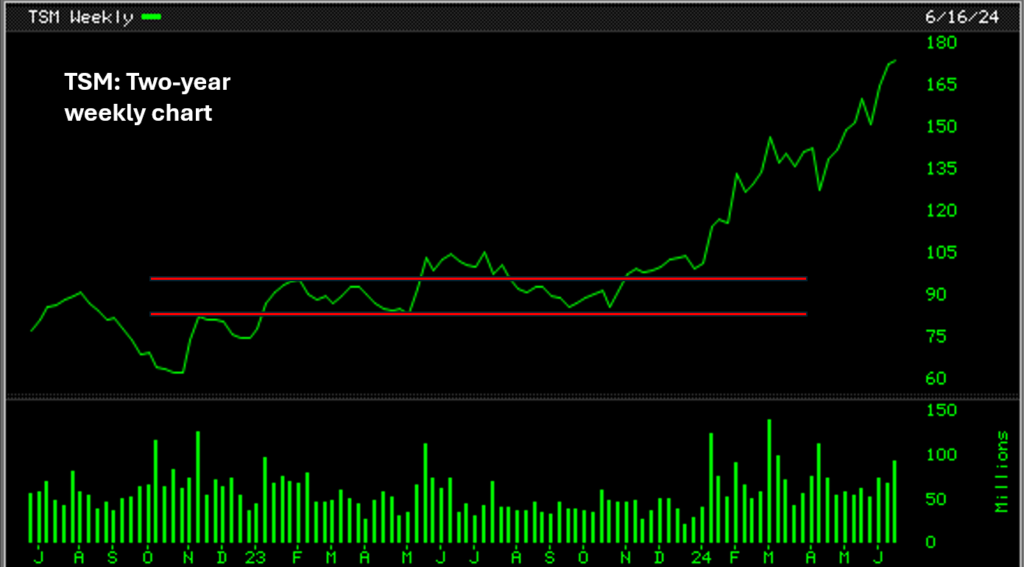

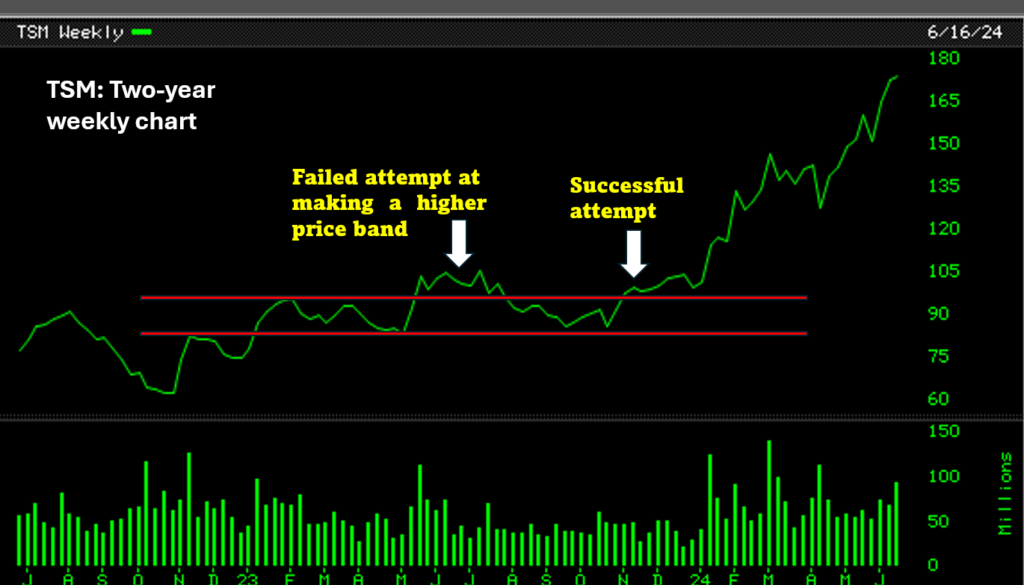

As a game to be played by yourself you decide to draw a couple of price bands lines. Just to see if anything can be deduced by drawing some price bands. And you draw two parallel red lines as shown below.

Initially you are not sure if the lines mean anything. And then it hits you as plain as day. Taiwan Semiconductor stock (TSM) was having a tough time getting over the $100 price. During the entire year from January 2022 to January 2024, Taiwan Semiconductor stock was having a tough time getting over the $100 mark. Eventually in Mid-January 2024 with the help of suddenly increased volume, Taiwan Semiconductor (TSM) managed to get over the $100 price. See the chart below.

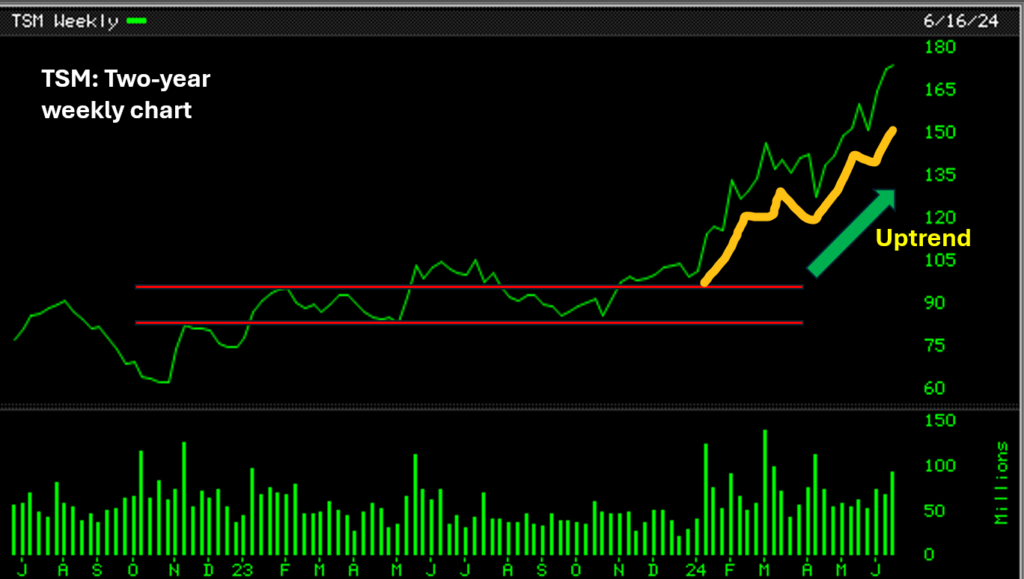

If you have an experienced eye, you will conclude that the first failed attempt at getting over the $100 price in June-July 2022 seems like a shakeout. Those who thought that the low was pegged at $62.01 in October of 2022 and were patting themselves on the back about catching the bottom of the Taiwan Semiconductor stock’s move, were suddenly thrown for a loop. A shakeout in June and July of 2023 took out a lot of early birds. And the true move looked to have started in early 2024. See the chart below.

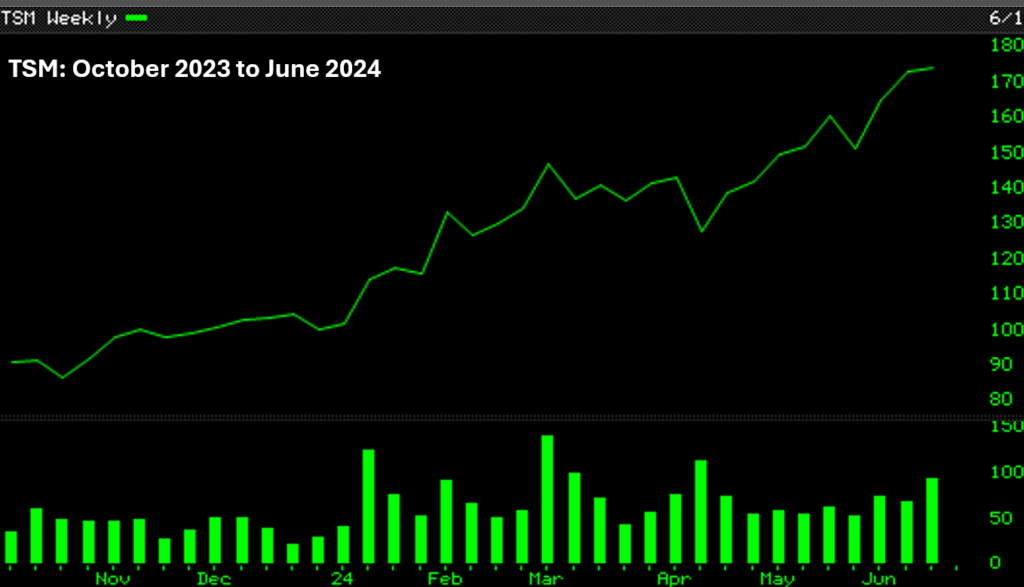

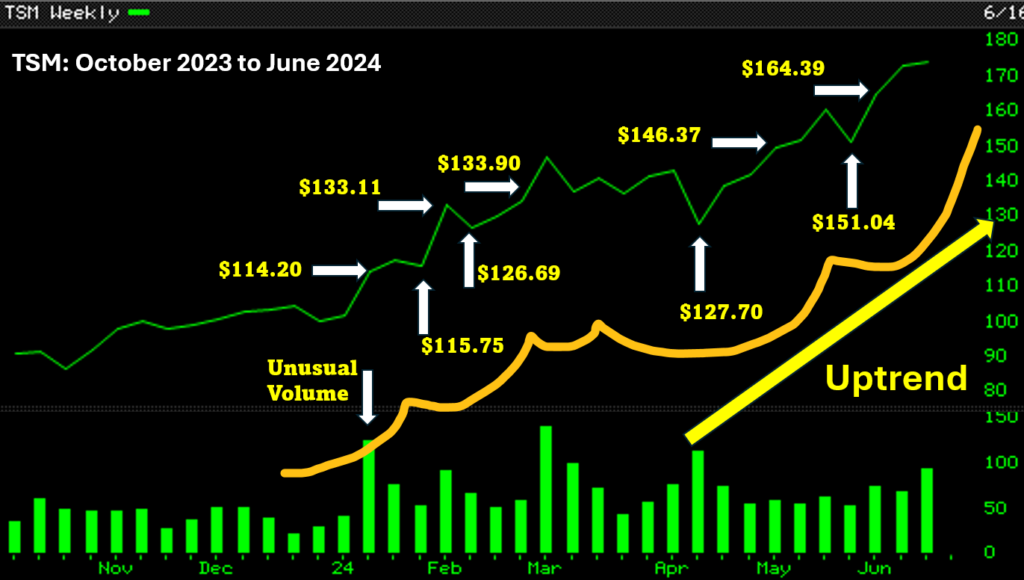

You were looking at the bigger picture until now. First you observed a five-year chart of Taiwan Semiconductor (TSM). And then followed it up by getting a bit closer by looking at its two-year chart. Now you decide to go in a bit closer still and observe Taiwan Semiconductor’s stock (TSM) movements from October 2023 to now, June 2024. And you come to the chart below.

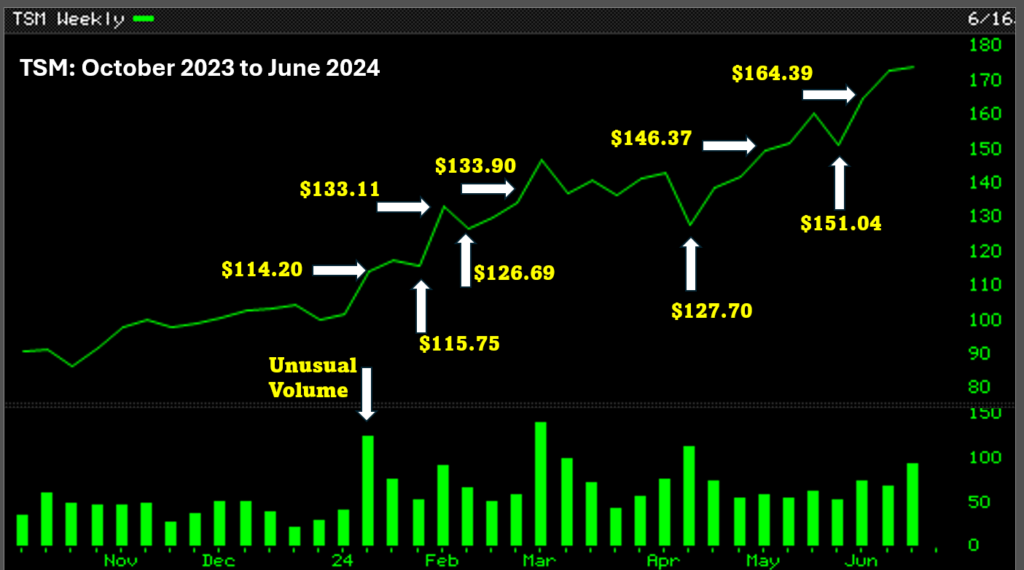

The uptrend in this chart above seems pretty straight forward. If you add in the prices at each new high and the corresponding higher low, the uptrend is clear as a bell. See the chart below.

If you hand draw a line to trace the higher highs and higher lows, the uptrend becomes clearer. Taiwan Semiconductor (TSM) had to work hard to get to this point. Months and weeks of hard work to get here where the price move upward has started.

Is Taiwan Semiconductor (TSM) In An Uptrend?

Stocks are bad. Unless it can make you profits. Is Taiwan Semiconductor a bad stock that can make you profits? After all that hard work to get here, there is no guarantee of smooth sailing. There will be hiccups and roadblocks. But how strong is Taiwan Semiconductor stock and how much conviction does Taiwan Semiconductor (TSM) have to overcome these hurdles?

Nobody can predict though many will make predictions and offer target prices. You know that target prices are just pure conjecture. No one has a crystal ball. Yet, humans never can stop themselves from predicting. Stay in the present and keep your rules in place and step-by-step you go week by week along the journey with Taiwan Semiconductor (TSM) as long it continues to maintain its prices above its prior low. Currently its last low was pegged at $151.04. Allowing for volatility and potential shakeouts by some of the players with deep pockets, a stop at ten percent below $151.04 or at $135.94 should prove if the uptrend stays in place. Until it makes a new higher low when the process repeats of you moving your stop up, you stay still and wait. If it comes back and hits your stop, the odds are that the roadblock is more than a roadblock.

To add more credence, perhaps you should look for additional confirmation from some of the other megacaps that are in an uptrend of some form or another. Names such are Eli Lilly (ELY), NVO (Novo Nordisk), Nvidia (NVDA), AVGO (Broadcom) and the usual suspects like Microsoft (MSFT), Oracle (ORCL) and Apple (AAPL) come to mind. Perhaps a look at their charts will add more to your confidence.

A recap of this article in video form is available below.