Can You Evaluate A Stock With No Name?

Some people just cannot get enough of technology stocks. Others are partial to healthcare stocks. Some are partial to biotechnology stocks. Other folks will only look at stocks of companies that are profitable. There are some who cannot get enough of IPOs. Each market participant has his or her approach to the market. That is what makes the market go around.

Somehow a diverse set of buyers and sellers come together to an agreement on a stock’s price for each day of the trading week. Without such a divergent view of the market, it is hard to envision the market’s existence.

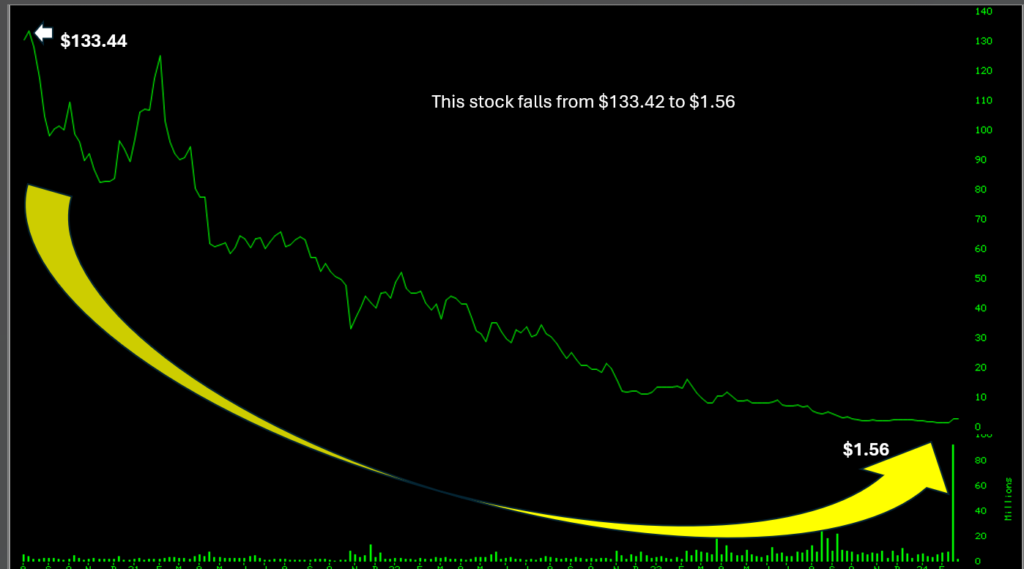

A piece of paper is worth $100 one day, and it could be worth $200 or just $1 a few weeks or months later. Like a watering hole drawing all creatures in the wild, the stock market draws people of all kinds. And as in the wild, there are predators around every corner, just waiting to grab the weakest ones.

Remove The Preconceptions And The Sight Might Be Better Than Imagined

Suppose you were presented with a chart of a stock that looks like this. No clues are given about the product or services the company sells. All you are given is the chart below. At least you are shown time to let you see its movements during the past few months. Aside from its price/volume action there is this element of time that is shown which is helpful. Following up on last week’s article, assume we keep going with the approach of ignoring the name and the business of the stock.

But this is crazy! How can anyone determine anything about this stock? No financial information, such as revenues, earnings, sales, P/E ratio, etc. No technical information, such as Relative Strength, moving averages, MACD, Money Flow, etc. Which industry is this in? What does it do for earnings? Not a thing, and one is supposed to evaluate this stock?

For the speculator, who relies solely on observation, the view is pretty simple. The stock is in an uptrend. It seems to have placed higher highs and higher lows. That is all that matters. The feedback from many savvy investors in most cases is that this stock has moved from a low price of $1.56 to almost $14. That is an eight-fold move and there is no chance for this stock to move any higher.

That is not the point. The last low was at $4.76. As long as that low is not violated, this stock can move about as much as it wants between $4.76 and $13.97, for as long as it takes. And its uptrend would still be considered to be intact. A methodical, step by step approach will be the right way to play the game.

What Is Your Frame Of Reference?

It is easy to look at the prior chart and conclude that a stock that has moved eight-fold has no chance to move up. Aside from such an outlook being wrong because of preconceptions of what a stock should or should not do will make one miss out on some unbelievable moves that some stocks can make. Most people get in too early and also get out too early. In most cases, it is better to arrive late enough to make sure a party is in full swing. And leave early enough before it gets either out of hand or becomes too rowdy. It is a skill to recognize the timing. Waiting for a move to have begun in earnestness is counter intuitive in the human mind which feels that the buy must be before the move begins, not after.

Just how many times have we seen a stock that goes up just keeps going up. And as soon as we get in, it feels like it stops moving up. Is it because when you are in a particular stock, you cannot wait out the reactions? But when you are not in the stock, you do not pay attention to its reactions but only to its new highs?

Everyone is chasing returns. And everything we have learned in real life is a detriment to making proper decisions when dealing with stocks. Sometimes good news is good and bad news is bad. And other times, goods news is bad and bad news is good. The insiders use news to trigger the reaction they wish to trigger. A speculator’s moves are not news related as he does not pay any attention to the news. It only matters if the stock is moving in a rhythm of higher highs and higher lows and that the speculator is in sync with the stock.

Same Stock, Bigger Picture

Suppose you were shown this chart of the same stock previously shown above. That eight-fold move up does not seem that ridiculous now, does it? Suddenly, the possibilities seem different.

At the beginning of this article, it was mentioned that a stock’s price, a piece of paper, could be worth $100 today and just weeks or months later be worth $1. This stock proves the point. Suppose now that have read this far along, you are told that the two charts shown are for the stock of Emergent BioSolutions (EBS). And that revelation, that this is Emergent BioSolutions (EBS) stock chart, should not matter one iota. The picture is what the picture is.

Whether the stock will offer opportunities or not is not the question. Should it offer opportunities, do you have the skills and the discipline to play the game the right way? Stocks on one’s watchlist are there because they acted a certain way. If the market is right, many stocks on the watchlist will maintain their stops intact. The operation is simple. The discipline is not.