Are The Biotechs Missing In Action?

The point has been made that you either love biotechnology stocks or you hate them. You love them when they make you money and you hate them when they take your money. Not much different from any other set of stocks. But there is something about biotechs that draws people. Especially, if you have ever experienced a big win in your journey as a speculator. No doubt there have been many losses to counter the big win, but if the game is played right, the one big win will more than overcome the many minor losses.

Therein lies the challenge. To play the game the right way. The general market run up since November of 2023 has seen many winners, most hard to catch and hold on to, with the exception of a handful. But so far, no big biotech winner has shown up. Usually, they tend to be the smaller biotechs. The past few months have not been kind to the small to medium sized biotechs.

Many smaller ones which showed early promise could not keep their attempted uptrend intact. They all shot out of the gate with great gusto, but the follow through move went missing. Some names that come to mind include stocks like Shattuck Labs (STTK), Ardelyx (ARDX), Nkarta (NKTX) etc.

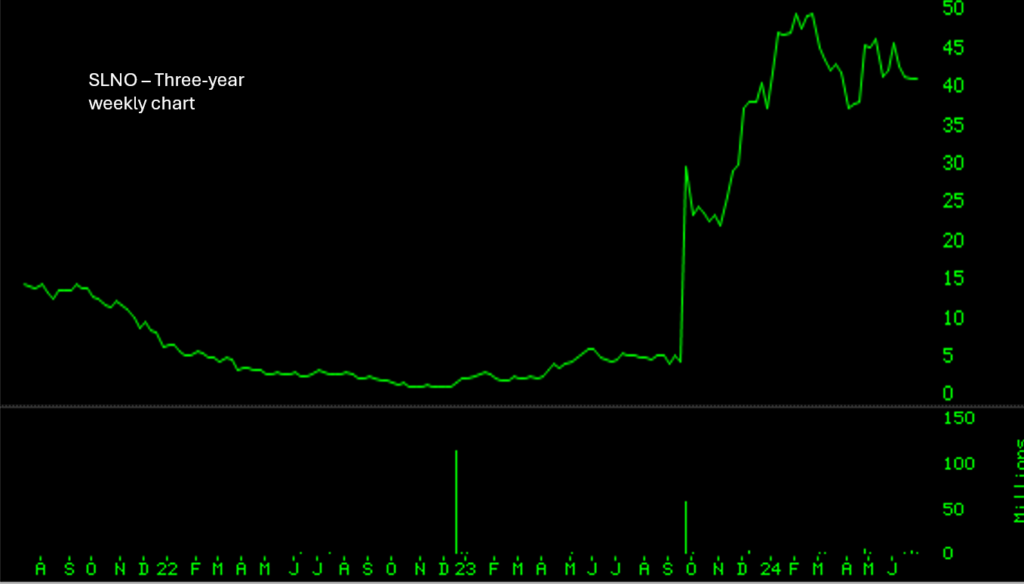

The one exception was Soleno Therapeutics (SLNO), which had a good run that started well before the general market confirmed its move, but it has been stuck now between $37 and $50 a share for some time. Is it the canary in the coalmine? Is it going to breakout above $50, or will it head back below $37 – either way foretelling the outlook for biotechs and/or the market?

But Soleno Therapeutics (SLNO) is just too small a stock to paint a broad brush across all biotechs. Some of the leaders are still chugging along, stocks such as Novo Nordisk (NVO) and Eli Lilly (LLY).

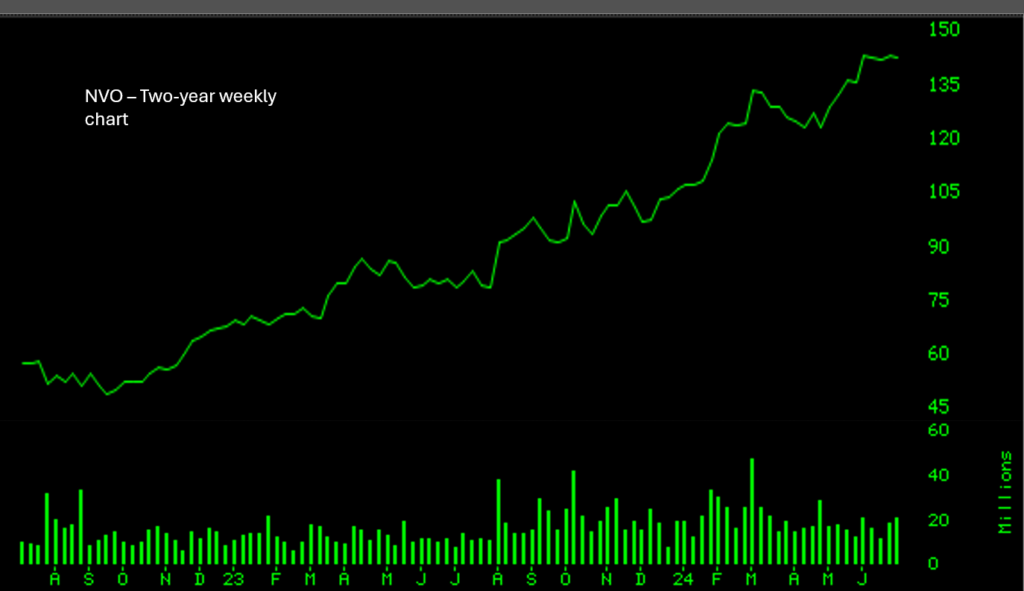

Here is the two-year weekly chart for Novo Nordisk (NVO). At first glance, does anything pop out at you?

Does it help if the same Novo Nordisk (NVO) chart with some lines and prices is shown?

No matter what one’s attitude and feeling towards charts, it does offer a clear picture of what has been happening over the past few months. There is little necessity to state the obvious about the chart for Novo Nordisk (NVO), so let us just move to the chart of Soleno Therapeutics (SLNO).

Yet again a basic chart like this may not offer much to some. So why not make it easier to see what is clearly obvious. None of this is rocket science and you do not need to be a genius at math or at econometrics or any smart sounding technical studies or an extremely detail-oriented accountant to see what Soleno Therapeutics (SLNO) is clearly telling us.

Does anything stand out? The price/volume action is unambiguous. The price bands are also quite clear. Soleno Therapeutics has been now stuck in a range between $37 and $50 for all of 2024. All of its move came in 2023 with hardly any gains for 2024. Did Soleno Therapeutics show early signs of its real potential? Or is that all the juice it has and has it seen its best days already?

The ones who sell anything to do with stocks will focus on the bottom and the top and hype that Soleno Therapeutics (SLNO) made more than a ten-fold move. Sure. But a realistic tradable move was never anywhere near a ten-fold return. If a stock runs ten-fold, and somewhere in between during the move it offers a speculator a chance to double his money, he will call it a stock that made him money. To him, it still is a bad stock, because all stocks are bad. It is the programmed mind that thinks stocks are good investments, especially in the long run. That is a line sold to the gullible by the Wall Street machinery. What else can you expect from the best and the brightest who use other people’s money to make their own living?

Each stock makes its own journey at its own pace. However, the overall general market needs to be in the right direction to invite the right amount of funds to move a stock. Now, will stocks like Soleno Therapeutics (SLNO) continue to rest when they need to rest before making another run with renewed energy? Or will they run out of gas and find it hard to keep the current trading range?

Will biotech lovers get their chance in this market? There have been other biotech stocks that have been previously discussed in prior articles here. As an exercise, it might be worthwhile to dig into the chart Eli Lilly (LLY) to see if it shows some of the same signs as Novo Nordisk (NVO).

A synopsis of this post is here in video form: