The Usual Suspects

You have been searching and searching and the same stocks keep popping up on your watchlist. Yet, making gains continues to be as challenging as ever. And the human mind being the human mind tries to convince you that you are missing out and you see all those services whose sole job is to hype stocks claiming to have made a ton of money.

Sure, if you just bought the right stock at the right time and continued to sit through all the swings, as if you bought the right stock and forgot that you owned the stock and then one day you recover from your amnesia and remember your stock. And you check the stock’s price and maybe, just maybe, by some chance you might be a bit ahead.

One of the stocks that belongs to The Usual Suspects club is Viking Therapeutics (VKTX).

Is Viking Therapeutics (VKTX) A Good Stock Or A Bad Stock?

All stocks are bad. Occassionally, a bad stock can be good. What makes a stock that is bad suddenly become good? If a stock makes you money then it is good. But it only lasts for a few months, and if you are lucky, to a little over a year at most. And then it goes back to being bad. How to recognize the periods when a stock is good and offers opportunity to make money? When the trend is unimpeded, a stock can be good. During all other times, stocks are bad.

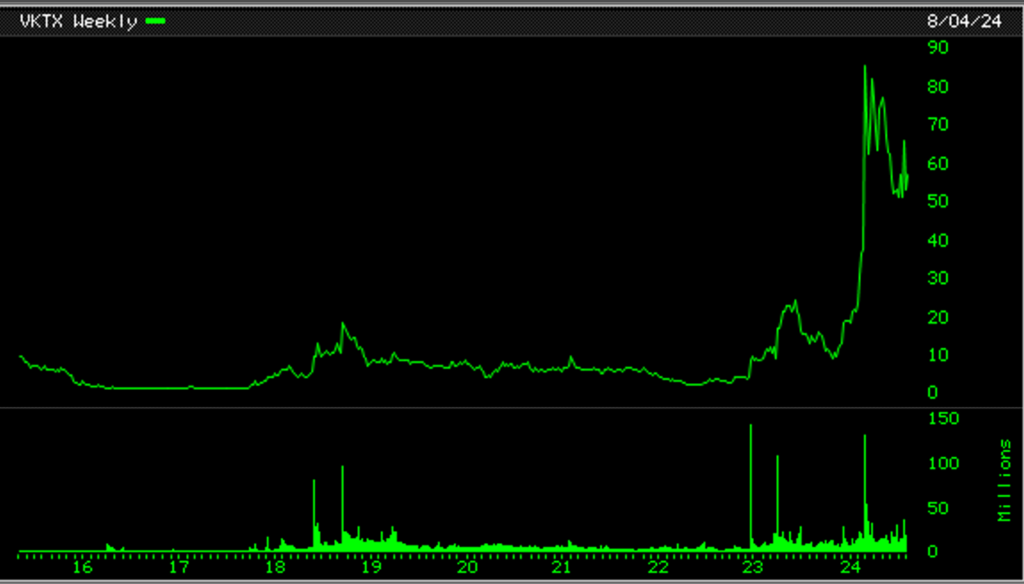

Take a look at an all-time chart of Viking Therapeutics (VKTX). Is this a good stock or a bad stock?

What Does Viking Therapeutics (VKTX) Want To Do?

There are many features in the chart of Viking Therapeutics (VKTX) that seem to indicate the tremendous potential. But timing is everything and it needs to be in real time. The insiders know that there are a bunch of speculators waiting to buy Viking Therapeutics (VKTX), but only if it acts in a certain way.

And there are others who will oppose the insiders for various reasons. Maybe to test the insiders’ resolve. Or maybe to bet against the insiders because there are always bets that go both ways, that is what fixes a stock’s price. If the insiders prove their mettle, then the bettors against the insiders will reverse their position. And that allows the insiders to distribute their stock.

This game of cat and mouse goes on for as long as it takes. In stocks you can never be early because the early mouse gets eaten by the cat.

Is This Really A Bull Market? Or Is This A Bear Market?

It does not matter to the speculator. Why are humans so quick to attach labels to everything? There are periods when you are unable to peg things into defined labels. And quite frankly, by the time the market gets to the definition of a bull or a bear market, a good amount of the move has already been on for a while. And more often than not, fakes will exist to catch the novices wrong-footed anyway.

It only matters if stocks are being good, which means that stocks are making you money. If stocks are their usual self and being bad, no label will help. All the content out there is to explain the stock’s move after the move.

Can Viking Therapeutics (VKTX) Offer Any Clues?

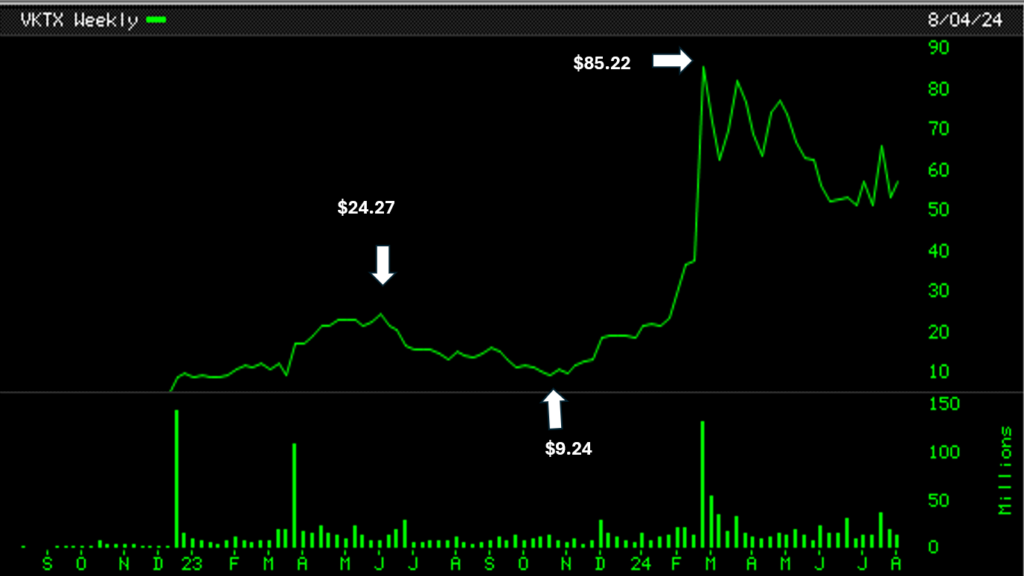

Yes, of course, there are always clues. Whether the clues will help or not is another question. Here is a chart for Viking Therapeutics (VKTX). The obvious price points are shown. The stock seems to be in an uptrend. That is the clue as well as the conclusion. But can you profit from this information?

If you are a true speculator, you will see that the uptrend will not be negated until Viking Therapeutics (VKTX) takes out the prior low of $9.24. But the current price is $57. So, you see the clue is really worthless because it is not actionable. But what if it makes a new higher high above the $85.22 price? Then it may be actionable but how it acts before getting there matters. Which means, forget about tomorrow and just stay in the present. That is a roundabout way of saying, “Just wait.”

What Does The Chart Of Viking Therapeutics (VKTX) Say?

Not much more than what has already been discussed. But for curiosity’s sake, let us just play along and look at other pictures offered by Viking Therapeutics (VKTX) stock chart.

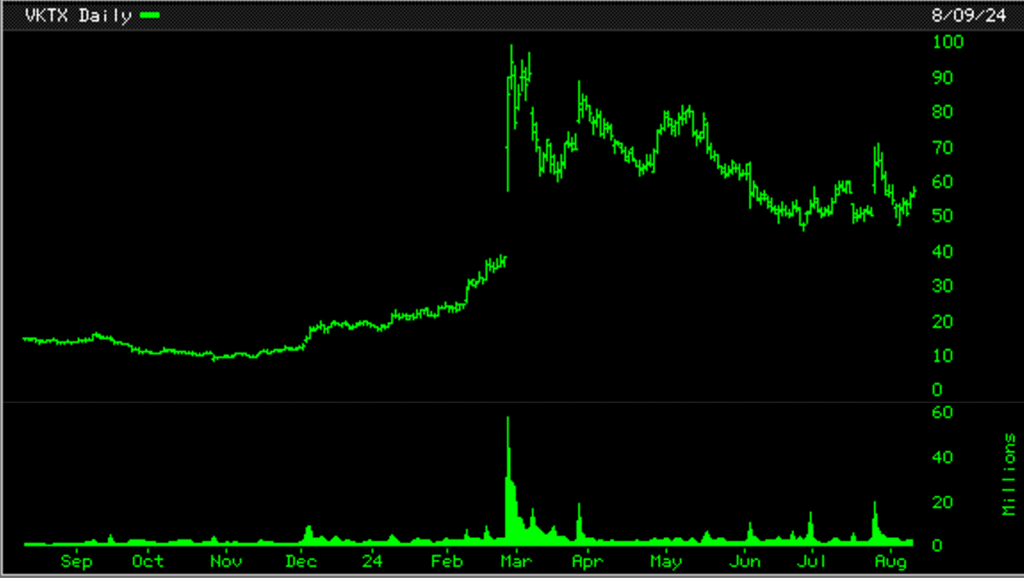

This is a daily bar chart (OHLC). Nothing much to see here besides the gap up. Was the gap up actionable? Maybe, if you know what you are doing.

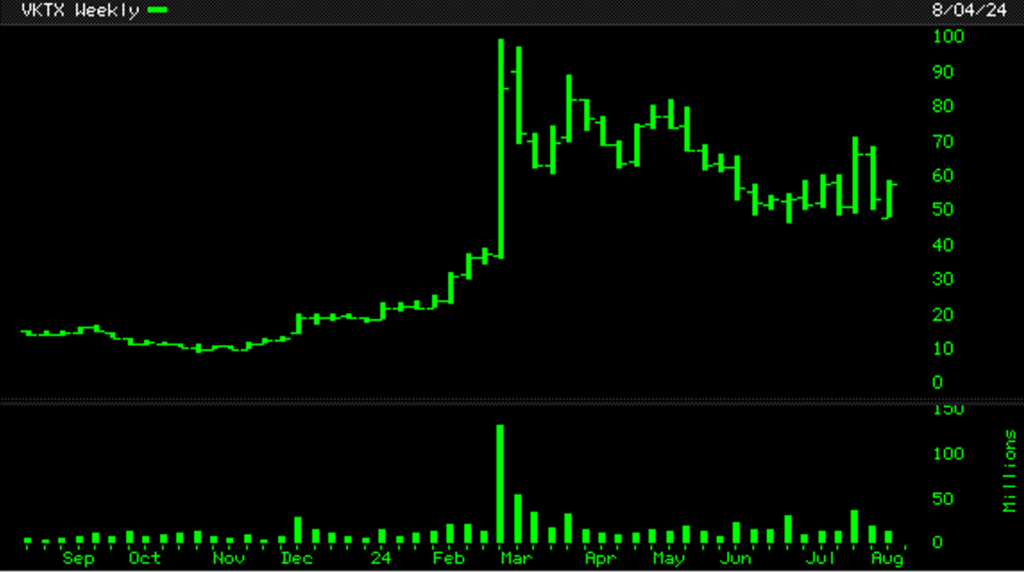

This is a weekly bar chart (OHLC) for Viking Therapeutics (VKTX). This is worse than the daily chart as there is nothing to glean from this chart. No actionable clues here.

The market could be saying that it is not in a down trend yet. And its uptrend remains intact. Some of the usual suspects may also be echoing the same thing. But if there is nothing actionable, you have to learn to sit tight until something actionable shows up. Some of the usual suspects are still maintaining their trends. Not jumping to conclusions is as critical as sitting tight until clear conclusions can be drawn.