Alpine Immune Sciences And The Biotechnology Sector

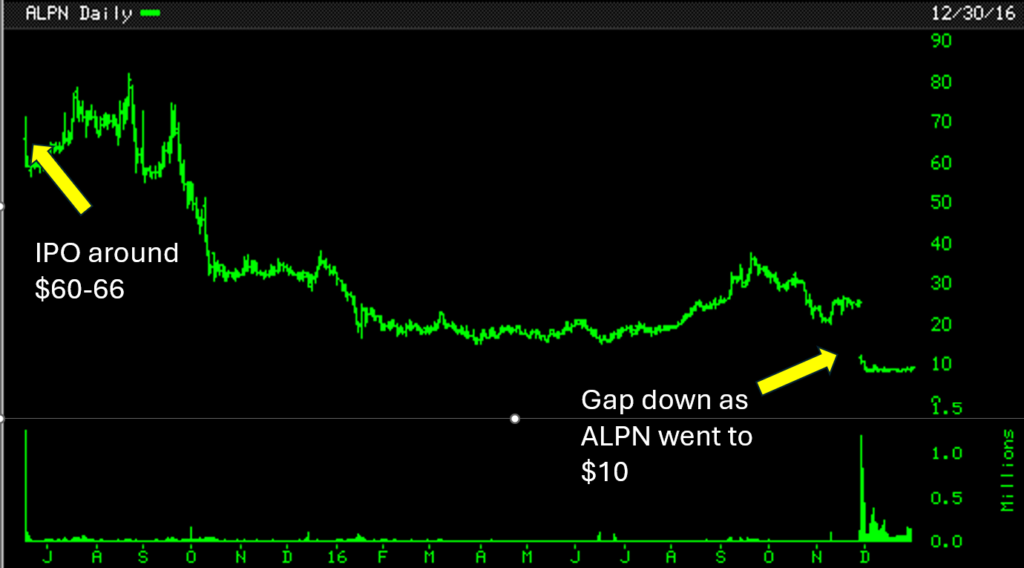

It was June 2015. The stock market was in a different space and at a different point at that time. Another IPO came to the market. The hype creators created the hype as is the usual case with any IPO. After all, these folks are experts at selling paper to a willing public. The IPO stock opened at $66 a share. It went as high as $71.36. However, it pulled back and closed the day at $59.68.

The salespeople are in the business of selling. The selling never stopped. Days went by, weeks flew by and by the time the new year of 2016 started, this IPO was trading at $29 a share. Well off its IPO price. “Hold it for the long term, just hold it for the long term.” What else are the sales folks going to say? That is the machinery.

On November 28, 2016, this IPO, which is a bit over a year old, closed at $25 a share. The next day, on November 29, 2016, shockingly the stock gapped down and opened at $11.48 and closed the day at $10.28 a share. Imagine buying the IPO at its opening price at $66 a share and a year later it is at $10 a share. Suppose you had bought at the IPO and now your account is worth 20% of its original value. What would a normal human mind say and act when faced with such a situation?

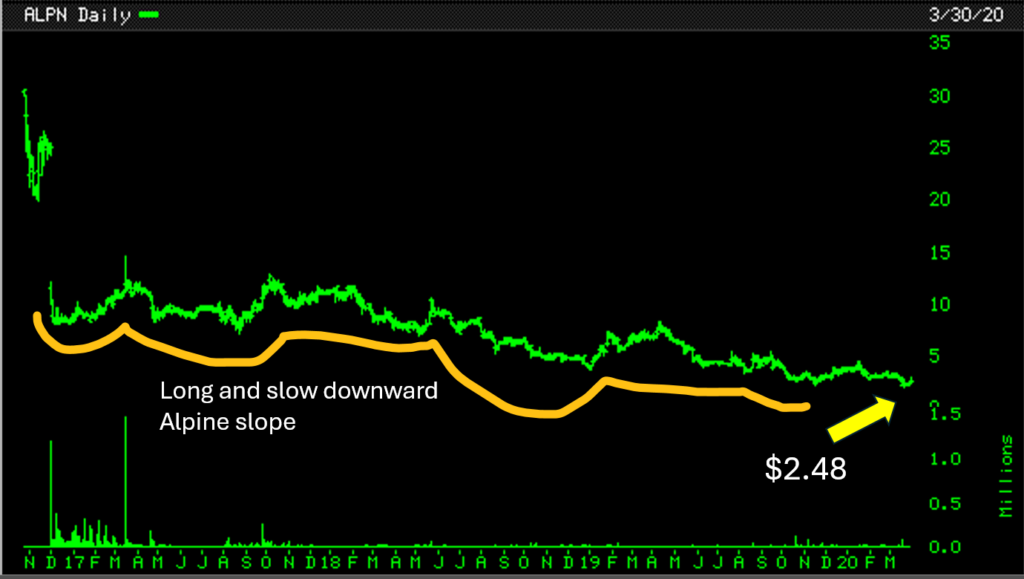

The $10 price was not even the worst of it. During the Covid- panic market, it went even lower. Not $9, not $6, not $4 but as low as $2.48 a share. It is hard to imagine the mental condition of someone who bought the stock at $60 under the premise of making a killing in a new IPO in the Biotech sector only to see it hit $2.48 a share. The stock had lived up to its name of Alpine Immune Sciences (ALPN) and had just gone downhill like an Alpine skier. From $60 a share to $2.48 a share.

Why Did Alpine Immune Sciences Explode In 2020?

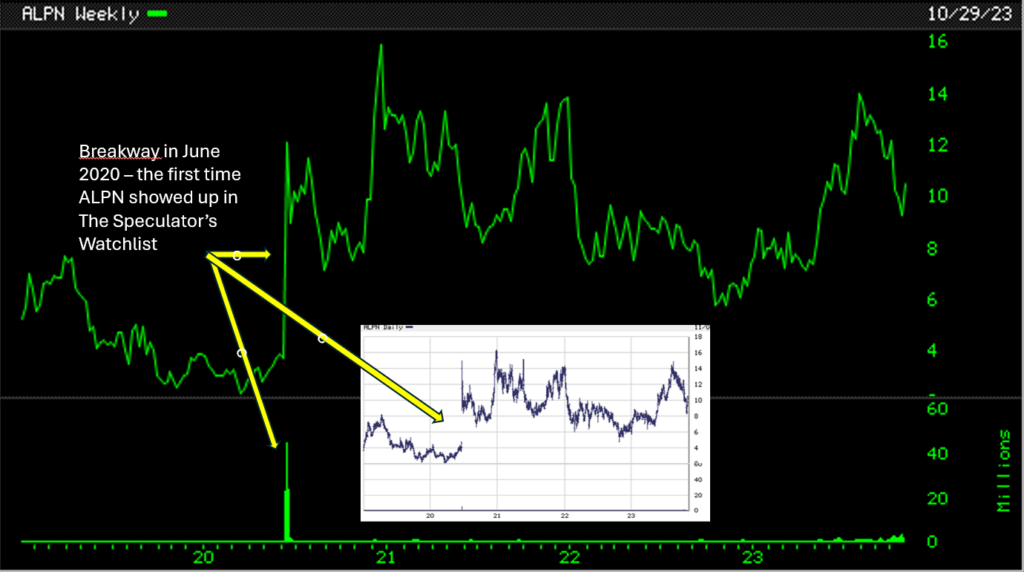

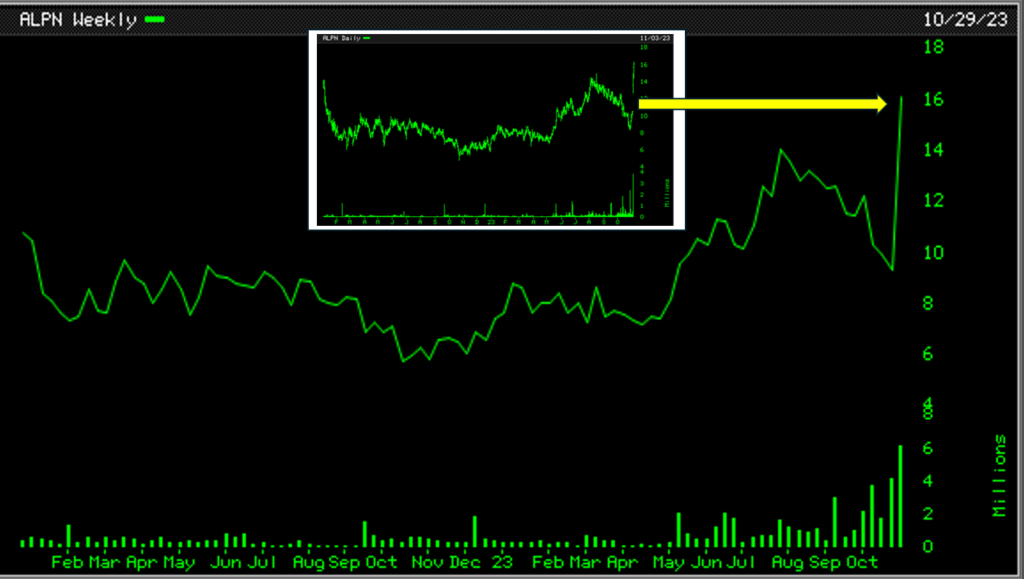

For most speculators, the existence of this stock, Alpine Immune Sciences (ALPN), did not ever register until June of 2020. A speculator’s nature is to observe. And interpret his observation. And then if an opportunity presents itself, to act on that interpretation. What do you observe in this chart of Alpine Immune Sciences (ALPN) below? The daily chart is inserted over the weekly chart.

For the speculator, the price/volume eruption in June 2020 was unmistakable. It was evident most likely to the novice’s eyes as well. But just seeing something is different from observing something. The speculator at once put Alpine Immune Sciences (ALPN) on his watchlist. Something unusual had happened. Yes, the news of that week was that Alpine Immune Sciences had signed an exclusive agreement of some sort to collaborate with a bigwig in the pharma industry called Abbvie.

The smart people and also the people who wanted to be thought as smart dissected the Abbvie agreement and concluded that it boosted Alpine Immune’s bottom line and it had warranted enough oomph to offer a gap up in Alpine Immune’s price with volume that was extraordinary. The Alpine Immune (ALPN) stock had closed the previous day at $4.66 a share. The following day, the day when it the gapped up, it opened at $14.05 a share. Volume has huge. The previous day’s volume was a meagre 49,500 shares. On the day it gapped up, it was 40 million shares. An incredible volume explosion from one day to the next of 800 times! The price had more than tripled at the open from the prior day’s close.

Most people chalked it up to the news of the Alpine Immune tie-up with Abbvie. But not the speculators. They knew something else was potentially up and the stock was now worth watching for more clues. It would take patience, which the speculators had plenty to spare.

Why Did Alpine Immune Sciences Rise In Price?

It would take until November of 2023, more than three years of dormant and sporadic up-and-down price hiccups for Alpine Immune to offer its next clue to those who were observing. On November 2, 2023, Alpine Immune gapped-up on volume high enough to be its highest volume since that day in 2020 when Alpine Immune (ALPN) had written its agreement with Abbvie.

Alpine Immune Sciences (ALPN) stock had a new three-year high at $16.07 a share on highest one week volume in more than three-and-a-half years. For the speculators, this was a signal to move the stock from the back burner on to the front burner. And see if it caught heat any time soon.

The stock had woken up, showing signs of action. The speculators were now awake too. The market in general was showing signs of life. Was Alpine Immune Sciences going to take advantage of improved general market conditions to do something that it had been waiting to do since 2020?

When Did Vertex Pharmaceuticals (VRTX) Decide To Buy Alpine Immune (ALPN)?

The speculators wanted to see how Alpine Immune would react to the new high it had made. Sure enough, the reaction was quick and on strong volume. But the price recovered and Alpine Immune (ALPN) made yet another new high to $19.42. The move from the recovery to its $16.07 high to its new higher high of $19.42 was more than twenty percent in less than four weeks.

All the parameters were being met. The speculators were now looking for an entry point to buy in an experimental purchase of Alpine Immune Sciences (ALPN) stock. The stock was speaking to them. Something was up. Insiders were on the move. It was time to act to join in with the insiders.

The reaction from the high at $19.42 was short as a new higher high at $20.45 was swiftly pegged.

Thereafter, the move was in full force with just a short quick shake out at $34.91 during the week before Alpine Immune got bought out by Vertex Pharmaceuticals at over $64.

Just a thought exercise. Would you care to guess when during this entire time when Alpine Immune Sciences (ALPN) was moving up, down and up again, did the actual discussions of the buyout start? If you were Vertex Pharmaceuticals, the buyer, when do you think you would have first considered the purchase? The insiders knew things well in advance, which goes without saying. Do you think the stock’s price-volume action gave you any hints?

It is not so simple as the CEO of Vertex picking up the phone and calling the CEO of Alpine and saying, “Hey man! Like your product line. And the talent you have. I want to buy you.” Several layers of conversation take place. Weeks and months and sometimes even years of negotiations go on. The folks with deep pockets and who want to make the stock move do the things they do that show up on price-volume charts. But only if you are observant. And when such things show up on charts, do you interpret the price-volume action correctly? And can you act with discipline? None of it is easy. If it were, everyone would be doing it.

The fact is that it can be done, if only you put in the work and the time into becoming the perfect speculator.