How To Approach The Stock Market?

We are perfect speculators. Or are on the quest to become perfect speculators. It is a marathon of a journey. If you try to sprint from the starting gun, in a marathon you will not even make it past the first mile post. In stock market parlance, get wiped out in the first season. A sprinter in a marathon has no chance to get past the first few hundred meters, let alone making it through the twenty-six-mile journey. Some marathoners are able to pace themselves to make it through the excruciatingly tough journey to become an expert marathoner, not unlike the journey of becoming a stock speculator. But the winners are able to set a steady pace until towards the end when they can kick it up a gear and find within themselves with a second wind to propel them faster and faster as the end appears to be closer and closer.

Amazingly, that is a pretty good metaphor for the perfect speculator. When a speculator encounters a potential winner of a stock, he always operates in real-time. He tests the stock with an experimental buy. He knows that he could be wrong in his assessment of the market as well as the stock with which he is speculating. There is a methodical approach of slowly building his line in his positions. At no time is his line such that he would get hurt. He knows that capital preservation is far more important than a potential win. A bird in hand is worth more.

Just like the marathoner, as he passes milepost by milepost, he places his line, he paces himself and when it counts the most, he accelerates his line to make a really big winning move.

What Is The Point Of A Stock Watchlist?

A watchlist is your target pool of stocks. Somewhere, within that pool is a really big winner. As if in a pool of fish, there are one or two or more that have a diamond inside of them. The actual number of fish with a diamond varies from season to season, for stocks it varies from cycle to cycle. You are watching this pool of stocks for clues as to which one has the diamond. Since you only have a limited amount of worms to place on your hook, you have to optimize the bait. In the case of stocks, your trading capital is limited no matter how big the account value, it still is limited. And it has to last you a lifetime. So, you have to optimize the available trading capital.

The challenge for most operators in the stock market is to make real-time decisions. The human mind is so programmed from the time we learn to walk that is very difficult to unlearn the things we have learned over decades and decades of training. This unlearning process takes time, many years in most cases. Many cycles.

The Need To Predict!

There are many things that need to be unlearned. Among them the most common obstacles are the need to predict, the need to anticipate, the need to prove yourself that you are smart, the need to buy before a move has really started, the fear of missing out on a move, the challenge to wait to confirm that a move has truly started. All of these are trained impulses. The human mind has been trained over and over again for so long that the unlearning process will take time. Only the perfect speculators have time. And, as a consequence, only they will survive the challenges of the market and allow stocks to show them the way in real-time. A speculator’s action in not before a move starts. He waits and waits to make sure the move has definitely started. His real time actions show and prove to him that a move of significant proportions has surely started. And still his operation is such that he protects himself in the event he is wrong in his assessments.

Diamond Therapeutics (BDTX) On Your Watchlist

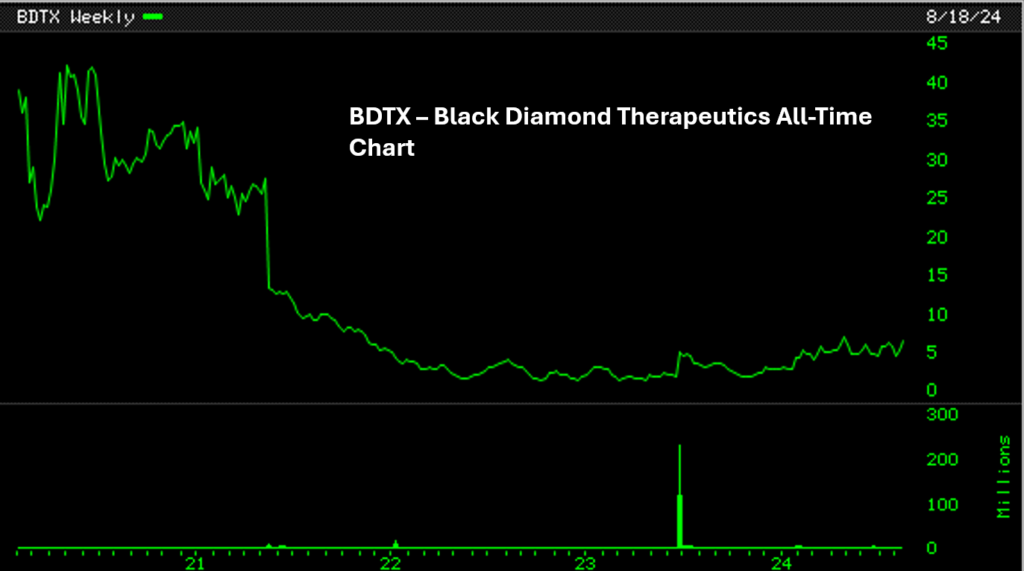

Has the time come to pay attention to biotechnology stocks now? How many biotech stocks are on your watchlist? Are they telling you something? What if what they are telling is a red herring? Are you prepared to take proper steps in real time and still protect your trading capital? Look at Black Diamond Therapeutics (BDTX) stock chart. This is an all-time chart. What does the speculator in you observe if anything?

Is Black Diamond Therapeutics (BDTX) At New High?

Black Diamond Therapeutics (BDTX) is not at its all-time high. Is that reason enough to ignore it? If you have to wait for its all-time high, we have to wait for it to make it all the way back to a price above $45, which is far away. What are the current market conditions? Are there very many all-time highs showing up? These are observations and interpretations you make. And based on your interpretations you decide to either act or not act. Those decision-making skills need time to develop because you have to experience the scenarios yourself. You have to learn by doing. If you do not do it, you do not learn.

Black Diamond Therapeutics (BDTX) At New 52-Week High?

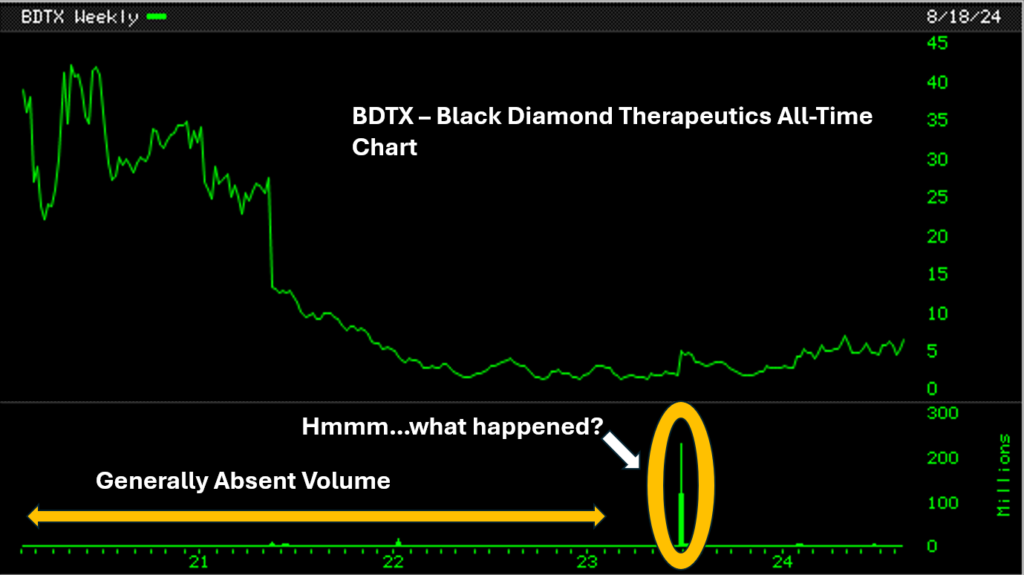

Let us suppose you are solely relying on what you observe with your own eyes. And not through any preconceptions in your mind. And look at the same chart shown above but with some markings and notes as shown below. Take a second to observe the obvious. Line up its move with what you know from experience of the general market’s behavior from spring of 2021 to November of 2023. Do you observe anything in Black Diamond Therapeutics (BDTX) stock chart below?

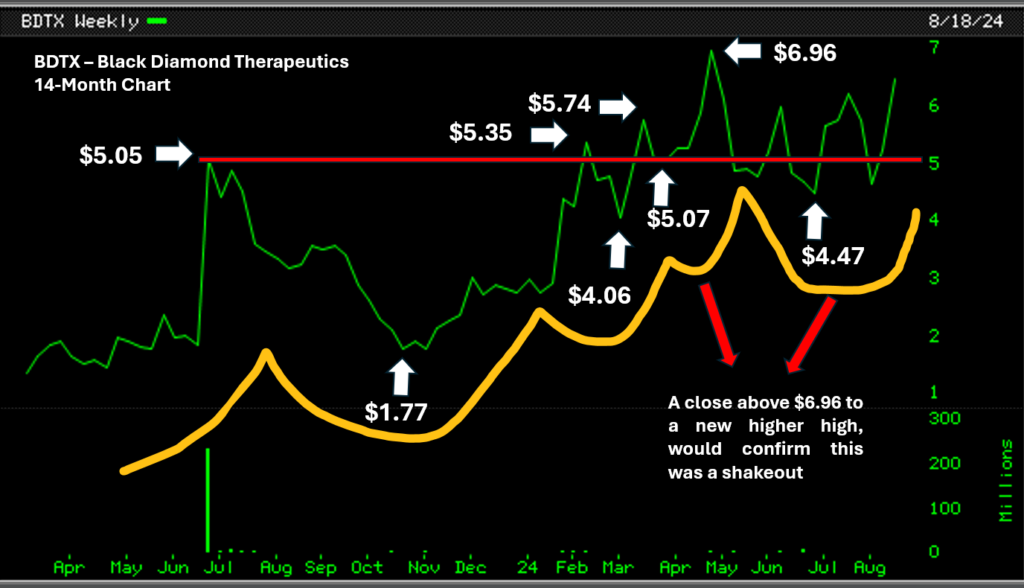

Is Black Diamond Therapeutics (BDTX) In An Uptrend?

What is your definition of an uptrend? A series of higher highs and higher lows. It is simple enough to understand and observe. But is real time action just as simple to execute? The mind acts as an impediment because it has been trained to deal with real life or what the people who trained you thought are real-life situations. But a speculator knows that real-life sitiations and what is considered logical in real-life has nothing to do with the stock market.

If you look at the chart below, would you be able to observe an uptrend? Has the move really begun? Is it too early? Is the time right? If your observation is that it is too early, there is no action that needs to be taken. If your observation is that a move might have started, do you have the rules of speculation that is in sync with your personality, your mental make up, your indiosyncracies, your strengths, your weaknesses?

A stock is a big winner only in hindsight. In foresight, in advance, nobody can guarantee anything. That is the reason your skills at navigating a move in real-time is critical. Practice makes perfect. But when practicing start with practice on paper. However, the real learning happens when real capital is at risk. During the learning process keep the exposure minimal. Otherwise, you will end up exhausted and out of trading capital within the first few hundred meters on a twenty-six-mile journey.

But Black Diamond Therapeutics (BDTX) is a small stock. There is not enough liquidity to suit your trading capital. If you are a beginner, use it for paper trading practice. Otherwise, wait for a bigger stock to show up or look to some of the ones from prior blogs in a similar field such as VKTX, CRNX, ADMA, VRNA, etc. Everything boils down to developing skills of observation, interpretation of your observation, action based on your interpretation. The skills of speculation.