ImmunityBio (IBRX) Is Trying, Can It Succeed?

Without paying attention to the name of the company behind a stock, can anything be concluded by just looking at its chart? Yes, everything can be concluded by just looking at a chart and without knowing what the company does to earn its income. Though with a name like ImmunityBio it is plain to see what its business is – clearly biotechnology. And the ticker symbol IBRX with an Rx, also indicates its line of business.

Suppose you did not know that this article is about ImmunityBio (IBRX). And if all you were presented with the charts below, would it have made any difference?

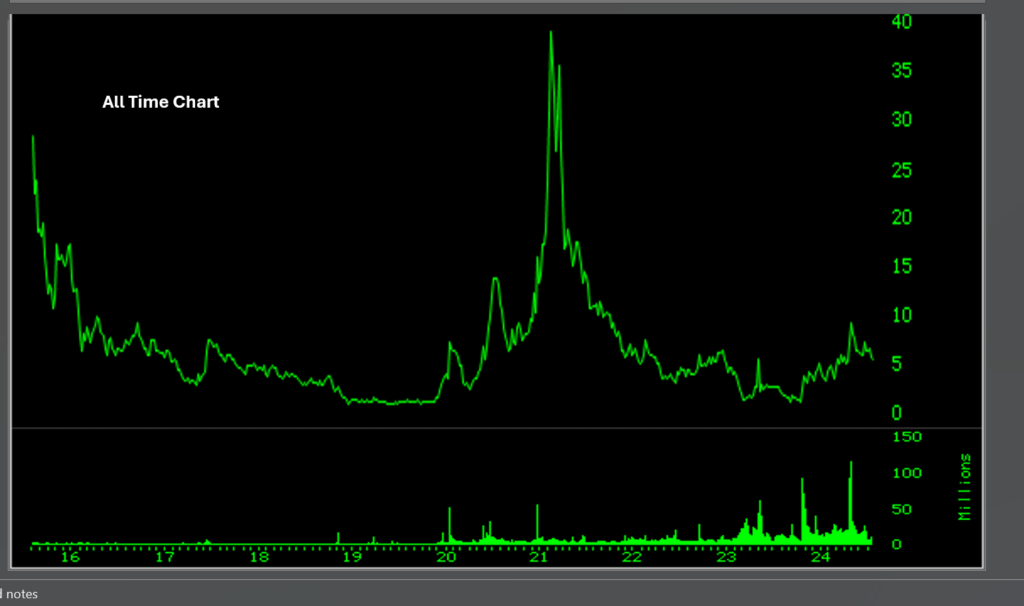

The All-Time Chart Of ImmunityBio (IBRX) Says…

Here is an all-time chart for ImmunityBio (IBRX). Obviously, nothing pops out. Unless you take an extra few seconds and pay attention to where on the chart price and volume move in sync with each other.

It is on purpose the name ImmunityBio and its symbol IBRX are removed from this chart and the charts below. To try and make one’s mind ignore the business and the sector that is being looked into. And focus solely on the price movements and the accompanying volume at key junctures along the stock’s price path.

If nothing stands out, suppose you focus only on the portion during the pandemic market. Let us assume that still nothing is clear. Suppose you look at the chart below. This is a more focused time period, encompassing the entire pandemic market.

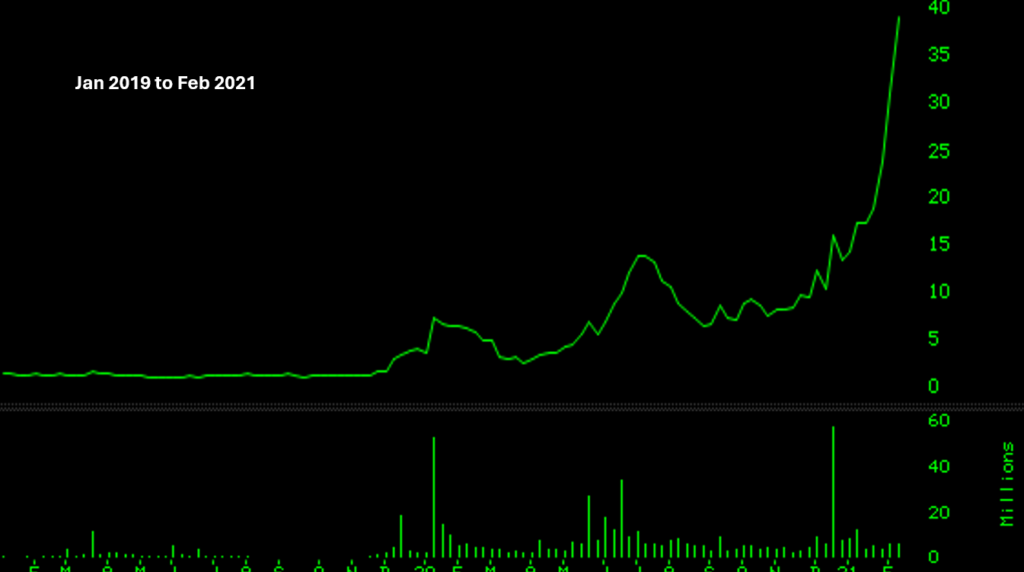

ImmunityBio (IBRX) In 2020 and 2021

To even the novice, the price/volume action is clear. There are jumps in volume that coincide with jumps in prices. Much of it is obvious.

But suppose you take a closer look at this time period and mark the price highs and price lows. And bring the picture much more into focus. And suddenly, ImmunityBio (IBRX) stock chart looks like this.

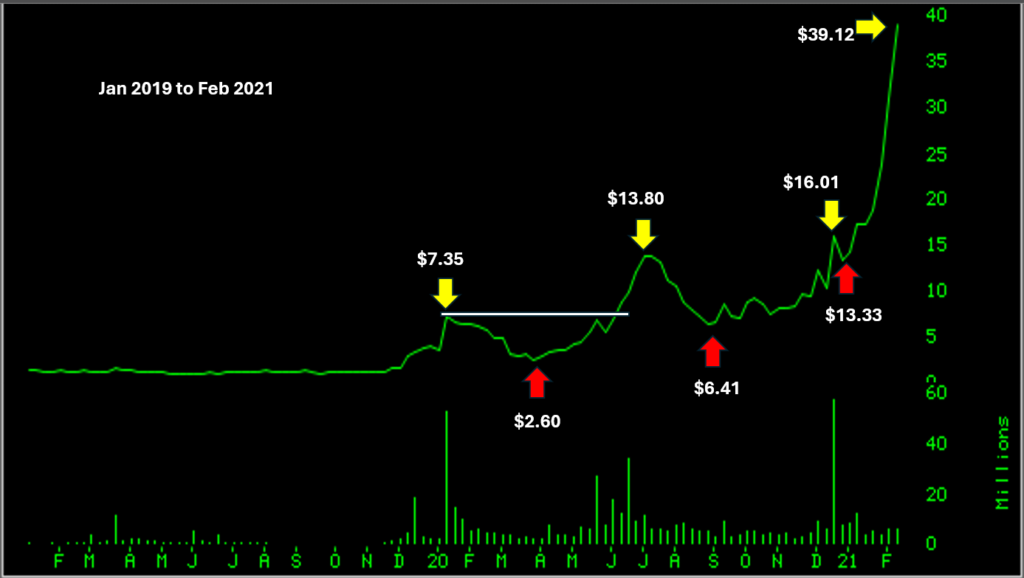

The uptrend, a series of higher highs and higher lows, becomes obvious. ImmunityBio (IBRX) wanted to begin its run from early 2020, even before the general market panic sell-off of March 2020. The tradeable move was from reassertion of the $7.35 high in the summer of 2020 to its high in February 2021. Though the price move was quite impressive, this being a biotechnology stock, a lot the success in capturing its move would have been challenging.

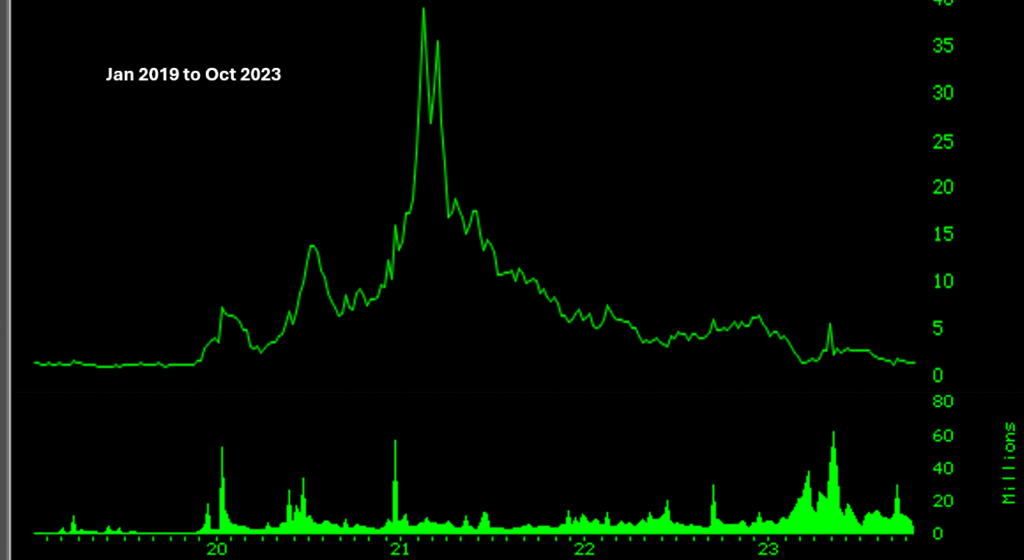

ImmunityBio (IBRX) During The Bear Market

ImmunityBio (IBRX) stock tracked the bear market in total tandem and from its high of $39.12 in February 2021 fell to its low of $1.29 and $1.31 in September and October 2023. Most of the move, from around $26 to around $3 was tradeable for the short seller. Does that mean for the longs, should an upward swing begin in all seriousness, a sizable tradeable move will be available?

Is it not funny just how clear things look in hindsight? Even the folks who pooh-pooh charts will acknowledge in their own private thoughts that the picture is so clear, as clear to make a blind man see.

Is ImmunityBio (IBRX) In An Uptrend?

As much as the human mind wants things to happen quickly, stocks take their time to make a move. It takes a long time for the stock to set up and get ready for a move. When the market is right, and the stock is the right stock at the right time, the move should be quite evident.

Is ImmunityBio (IBRX) the right stock at the right time? When is it the right time? Obviously, the right time is when the true move has started in earnest, not before. And not after. Here is the chart for ImmunityBio (IBRX) stock from October 2023 to today.

Do you see an obvious set of higher highs and higher lows? What does the horizontal white line depict?

Remember the earlier part of this article where we looked at ImmunityBio (IBRX) stock for two time periods. For the 2020-21 time period, it wanted to run even before the March 2020 sell-off in the general market. And then it ran up in sync with the general market in 2020 to early 2021. The long downtrend also tracked the general market. In keeping with a stock that shows a serious tendency to run, the run is usually big. Big up, and big down. The downward run was from $39.21 to $1.21. Now that is some downhill skiing.

The chart above offers plenty of clues. The price and volume action from October 2023 to now seem to bring enough buying at the right time. There are going to be challenges no matter what. If it were so easy everyone would be doing this. The support at around the $5 price could be tested.

So far, since October 2023, ImmunityBio (IBRX) seems to be in an uptrend. The deep pockets will test your mental strength. And the speculator knows that he could do everything right and still be wrong. The commitment must start methodically just in case there is no chance for a profit with ImmunityBio (IBRX), and your exit will result in minimal and insignificant loss.

However, should ImmunityBio (IBRX) be the right stock at the right time, it has the hallmarks of making a run of some significance. Whether such a move can be captured, should it occur, is the true challenge. No matter how good the set up by a stock, a move may or may not occur. Even if it occurs, it is possible that the move cannot be captured. That is because stocks are bad.