The Carvana Car Vending Machine

What is the first thing that comes to mind when you think of a vending machine? Candy bars? Soda? Chips? And probably other unmentionables in polite company. How about a car? A truck? A minivan? What if this car vending machine service comes with a delivery of the vehicle to your front door? How many have seen a Carvana car vending machine? Yes, it exists.

Now that you know and have probably figured out by its name, Carvana, what the core business of Carvana is, what do you think its stock (CVNA) can do in the near future? Would you like to know what it has done so far in its brief history?

The Carvana (CVNA) Stock Chart

The chart for Carvana (CVNA) stock can be broken into three major sections. The first section would be from its IPO till September 2021. For simplicity’s sake, let us look at Carvana’s stock chart from January 2019 to September 2021, let us call it the first section of the chart for Carvana (CVNA).

After a sell-off that coincided with the Covid-panic selling on heavy volume, CVNA stock rebounded from its depths of March 2020 price of $29.35 to a high of $360.98 set in August 2021. Since only liars catch the bottom and the top of a move, a realistic catch would have been from around $100 to around $234. If you used sound money management, you could still have come out ahead of the game rather than behind.

But for those who like to rely heavily or solely on price-volume charts, CVNA was not the right stock at that time. However, its uptrend of 2020-2021 did offer hints that sometime in the future, CVNA could find itself to be the right stock at the right time.

The Carvana (CVNA) Stock Downtrend

The bear market of 2021-2022 eventually hit almost every stock and CVNA was no exception. Let us now take a look at the second section of CVNA stock.

This is from the highs of August 2021 to the lows of 2023. The fall was quick, direct, and seemed without a break to even take a breath. The drop from a high of $360 to around $36 seems easy enough to recognize with an unending series of lower lows and lower highs.

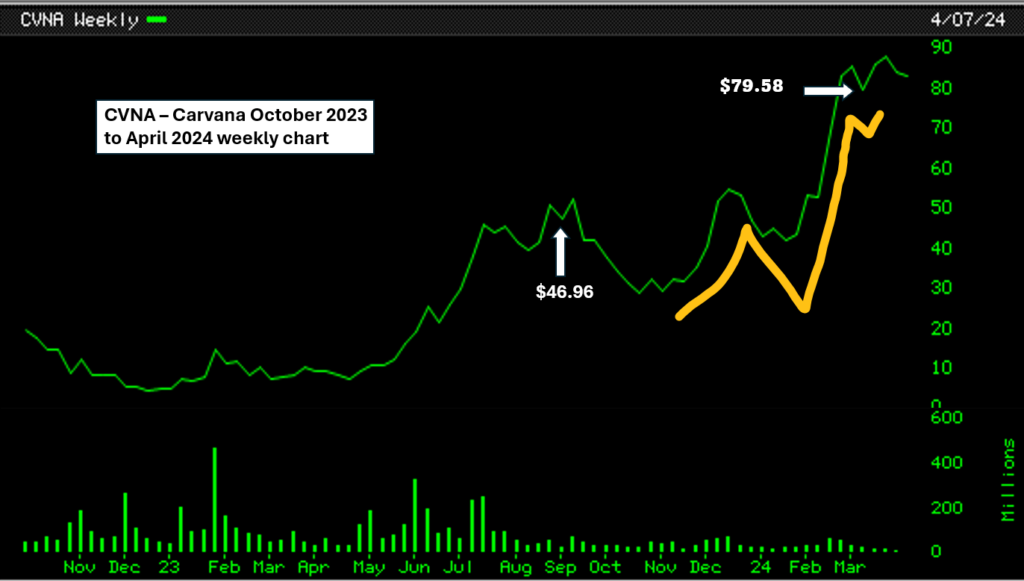

And now let us move on to the third section of CVNA stock’s historical movement. This chart below is from February 2023 to April 2024.

There was an early attempt at an uptrend from February 2023 to September 2023. The stock had a made a new high of $50.85 in late August of 2023. The reaction to this new high was to $46.96 as shown above. Then Carvana (CVNA) made a higher high at $55.20. Everything seemed to be going right. Until it did not. Confounding those who thought CVNA had begun a strong uptrend, the stock reacted and pegged a low all the way down at $28.58 in October 2023. This violation was not the typical 10% or even 20%. The reaction low went as low as $28.58 in October 2023. That is almost 40% below the prior low. Any protective sell-stop would have been triggered. Hence the attempt at an uptrend throughout 2023 had failed.

The Carvana (CVNA) Stock Trend

Now let us look at the third section of Carvana (CVNA) chart. Its next attempt at an uptrend started in November 2023, which is in sync with the general market’s attempt to end the prior bear market. This new attempt is indicated by the hand-drawn yellow line. If indeed this current attempt at an uptrend wishes to stay alive, its last low of $79.58 should not be violated. However, given the choppy nature and volatile nature of several leading stocks, it would be prudent to allow some leash for CVNA stock to tell us in its own way if it is the right stock at the right time. When a volatile stock like Carvana (CVNA) is in full charge ahead mode, a trailing stop 10% below the prior low makes sense. However, most big moves are hard to figure out during the beginning stages of the move. Is Carvana (CVNA) going to make it hard to hold on to it should it begin a true move? Since CVNA’s gap up of February 23, 2024, is not that far away, a stop at $65 would be a good test to see if the current uptrend attempt can hold.

So far neither the bulls nor the bears are making any serious money on Carvana (CVNA). Bears had their easy turn during the bear market of 2021-22. Will the bulls have their easy turn any time soon? Sure, those who wish to work at the margins and make a few dollars here and there find opportunities daily and weekly for a win here and a loss there and in the end, it is all a wash. More likely a loss at the end of the year rather than a win.

And those who are of the type that buy and forget the stock for decades could care less about Carvana (CVNA) right now and wouldn’t be reading this article anyway.

The real money is made on extended trends. And Carvana (CVNA) has so far not offered an extended trend yet. Maybe it is not the right stock at this time. Maybe it is biding its time to start a real move. Whether the move happens or not, no one can predict. You just continue your observation until you can draw a conclusion based on your observation.

A successful ride along an up-trending stock requires real-time action. Can Carvana (CVNA) stock offer such a ride? In hindsight everyone is right. The challenge is to be right in real time. The buying and selling actions happen in real time as it is happening. That requires buying when, to the human mind, it does not seem like the right time to buy. And you are required to sell when a predetermined stop is hit, because the human mind is a terrible thing to use when dealing with stocks. You will be surprised how many reasons you can manufacture in your mind to justify and rationalize your action and do the wrong thing in the stock market.

The right decision at the right time is usually the simplest decision, executed with proper rules of trading.