Is Verona Pharmaceuticals (VRNA) On Your Watchlist?

Do you know how much time, energy and knowledge capital is spent in the stock market to look for the next new winner? Do you ever wonder why is that a stock that is in a strong uptrend, just continues to keep on rising?

Everyone is chasing performance. Not just amateurs and novices, but even the professionals are chasing returns. Nobody comes to the stock market to take losses. The draw is in the promise of riches. Not so dissimilar from a casino. The draw is in the hopes, wishes and desires of wins.

If one is patient enough and prudent enough in the approach to proper placement of buys, sells and stops, an up-trending stock can make an account look quite good. But patience is required to wait for the move to begin in earnestness. Stocks on one’s watchlist are there for a reason. To watch them for clues and nuances. To see if and when an entry is warranted. And how that first move pans out. How to make the second move and so on.

Is Verona Pharmaceuticals (VRNA) Stock A Bargain?

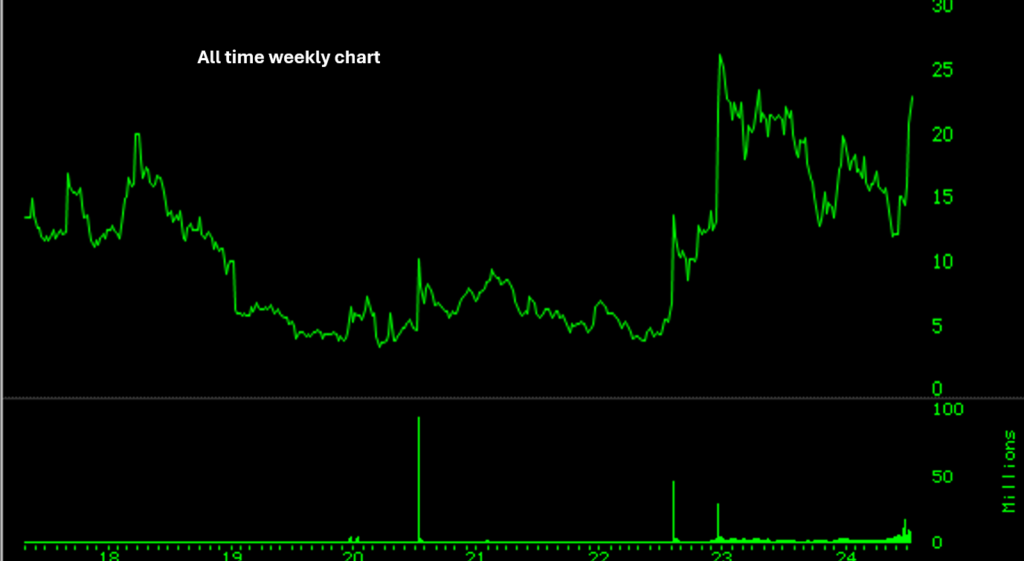

In this quest, Verona Pharmaceuticals (VRNA) offers some signs that make it worthwhile to put on your watchlist. Here is the all-time weekly chart for Verona Pharmaceuticals (VRNA) stock. Some of the clues are quite clear, and others not so clear.

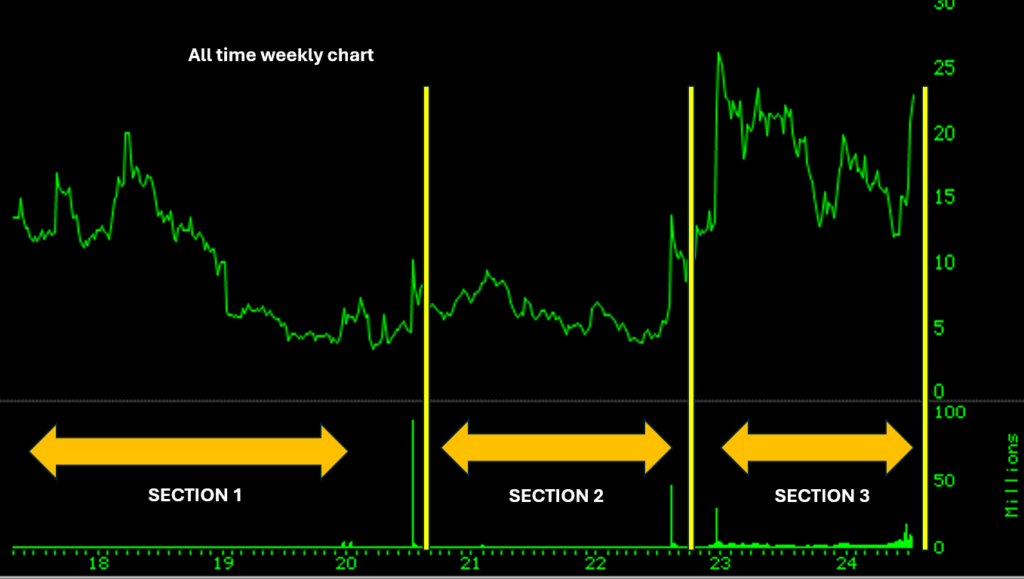

The time elapsed since Verona Pharmaceutical’s IPO has reached enough ripeness. The basing pattern seemed to have indicated decent enough price/volume action. To make it easier to observe, it is better to break the chart into three separate sections as shown below.

Section 1 is the first three years of Verona Pharmaceuticals (VRNA) stock’s life. From its IPO in 2017 to the first time VRNA showed some price/volume action that indicated somebody with some money was buying the stock. It does not matter what the reason behind this action is. It only matters that something happened that brought an unusual amount of money into the stock.

Section 2 is the section that maintains Verona Pharmaceuticals (VRNA) stock at a price level that is higher than the price lows experienced in Section 1. Furthermore, as Section 2 comes to an end, it shows an additional volume buy by either the same entity or a new entity as seen from the price/volume action towards the end of this section.

Section 3 is the section from late 2022 to date. Yet again, the low of section 3 is above the low of the prior section, Section 2.

Is Verona Pharmaceuticals (VRNA) Stock Rising?

It seems as discussed above; Verona Pharmaceuticals (VRNA) is making a higher low. But is it also making a higher high?

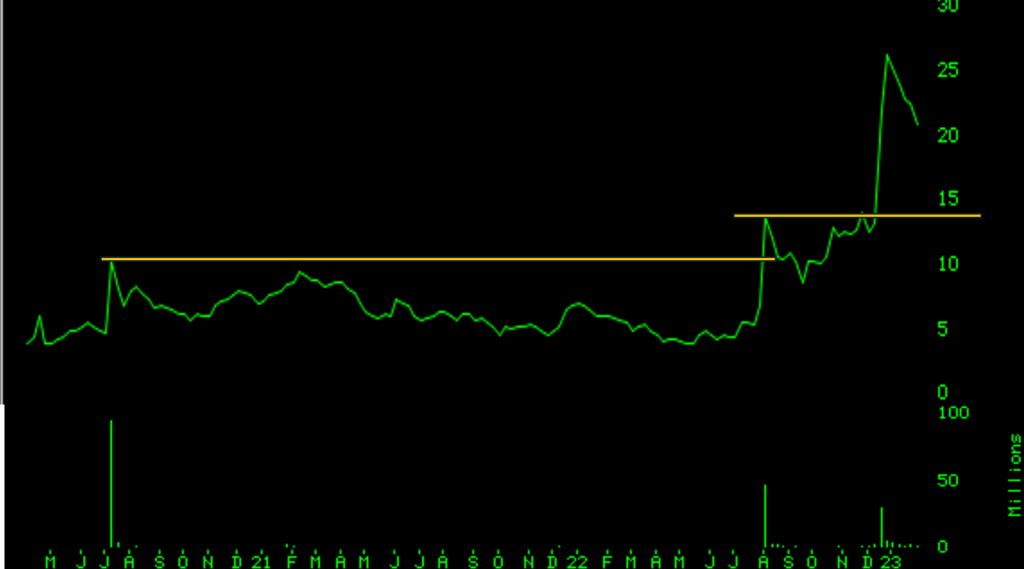

Let us say that the red horizontal lines indicate the support lines or the price lows. And let us suppose the yellow horizontal lines indicate the resistance or the price highs. It seems that from Section 1 to Section 2 is a step up and an intermediate up-trend. And from Section 2 to Section 3, the low is clearly higher. But the question still remains if the Section 3 high is higher than Section 2 high. There is still work to be done by this stock. If more clarity is needed, the two charts below will help. The first of these two charts focuses more on the specific time between July 2020 to early 2023.

And the second chart shown below focuses on the time between July 2020 to July 2024. And the clutter is removed by focusing just on the highs.

There will be some minor differences between how you view the chart versus how someone else views the same chart regarding exactly where the new high needs to be made. That is not the issue for the moment. Keep the main thing the main thing. A new higher high needs to be made. And just making a higher high is not enough. You have to continue to wait and see what kind of reaction ensues to the new high price.

Let the gyrations and whiplash associated with all the news about any FDA approval, disapproval or denial play itself out. The big money is not made at the margins on one day’s news. You are looking for a sustained trend. It may happen tomorrow or may never happen. But you will not know unless you observe the stock and its chart.

Verona Pharmaceuticals (VRNA) seems to want to go higher in price. And it very well might just do that. But the real question is whether VRNA can offer a sustained uptrend of significant proportion that allows the speculator to make a decent return.

Ignore the target prices, ratings, and predictions and all the noise in this incredibly noisy world and focus on what is happening day by day and week by week. Stay in your own bubble and in your own world. The clues will unfold. How and what you observe, and how and what you interpret based on your observations, followed by how and what action you take will determine the rest of the story as offered by Verona Pharmaceuticals.

No doubt there will be plenty of red herrings and head fakes along the way. That is the way of the stock market because stocks are bad.