To Observe, To Interpret And To Take Action

April 27, 2025

You sift through charts seeking potential gems. Unbeknownst to you, there are countless other eyes doing the same thing. Some have been at it for decades. Others use screens to cut down the amount of work. No matter what the process, the idea is the same. Can we observe and pick out a potential superior runner amongst a sea of stocks?

Being an observer is just a small step. What you interpret from your observation is a skill that few have. We started with a countless number of eyes seeing the market. Everyone is presented with the same raw picture of the market. But unsurprisingly, not all eyes that observe the picture see the same things. Where some see potential for a move up, others see a potential for a move down. And both could be right, just their time-frame could be different. The one who sees a long position making a profit may have six to nine months or more of a time frame in mind. The one who sees a profit in a short position may be approaching with a shorter time frame in mind.

The Perfect Speculator’s Approach

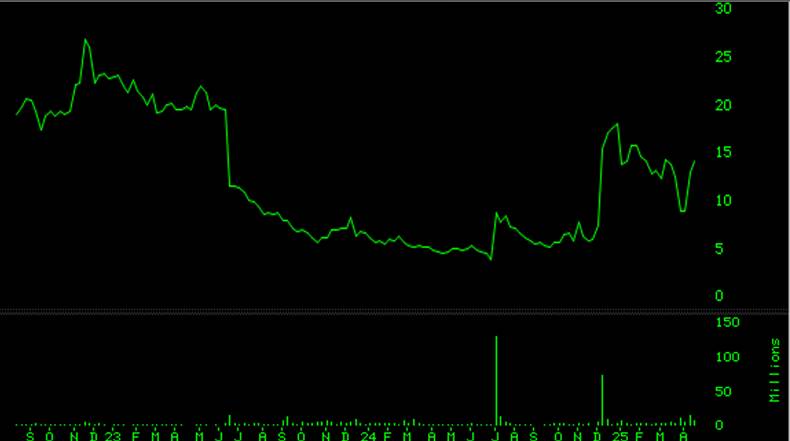

Let us say, a stock chart that looks like this one is presented to you.

And you are asked to make your observations and write them down. What would you write?

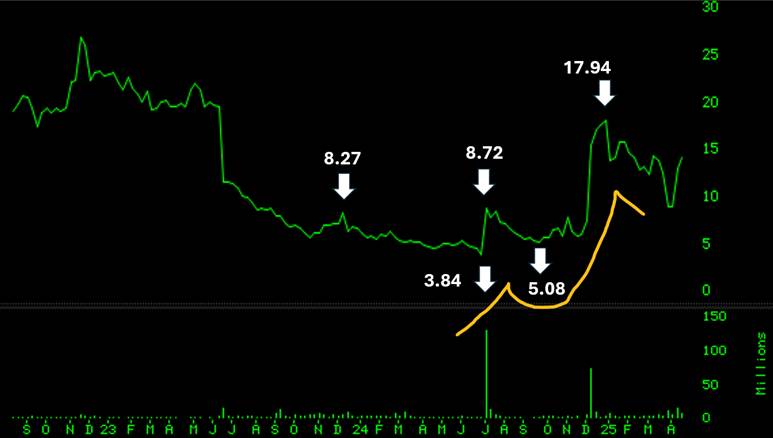

The obvious observations are usually the most reliable. The above chart is not enough? You need more clues? But by giving you clues, I may be making you lean towards my observations and interpretations, instead of letting you make your own. Your observations and interpretations need to be your own. Not infected with what other humans say or write. Suppose you belong to a very select few who are serious about running your own business of making profits in the stock market. In that case, you would take the time to mark all your observations and write down your interpretations. Perhaps the above chart may suddenly look like the chart below.

And then you would write down your interpretations in words, something akin to this:

The stock shows very clear price volume action which indicates Mr. Deep Pockets wanting to attract eyes to this stock. Where Mr. Deep Pockets are a bunch of insiders acting in collusion. They have decided for whatever reason that this stock’s price must rise. To the speculator the reason matters not one bit. It only matters that the intention is there by someone with deep pockets to make the stock’s price run.

We do not know how far they want to make this stock run. Could be $20. Could be $40. Could be $60. But we also know that the game has started. Just as someone wants to make this stock run up, others join the party to beat it up and beat it down. And their time-frame is different than the time-frame of the insiders. And thus, the game begins of the stock moving up, down, up, down and so on. The only question is whether the up, down, up, down, up and down moves show a consistent uptrend or not. That is, every new high is higher than the prior high. And every new low is higher than the prior low. And based on how, what, when, why you interpret what you interpret, can you then take proper actions along the way that allows you to profit? And what if we are wrong? Do you have an escape valve?

This is not an easy process. It is simple, but not easy. If it were easy, every would be doing this. It is simple like a Swiss watch. The simplicity of the Swiss watch is in its main function, which is just a bunch of gears arranged to work in tandem. But its actual mechanism is complicated and hard to replicate.

No different when one is running a business of speculation in stocks. Just buy at new highs and continue to place a trailing stop. Everyone knows this main rule. But the actual mechanism is complicated and hard to implement because we humans have stupid human tendencies. And we require very specific rules to implement our actions.

The example of the charts used above belong to ticker symbol is QURE (Uniqure N.V)